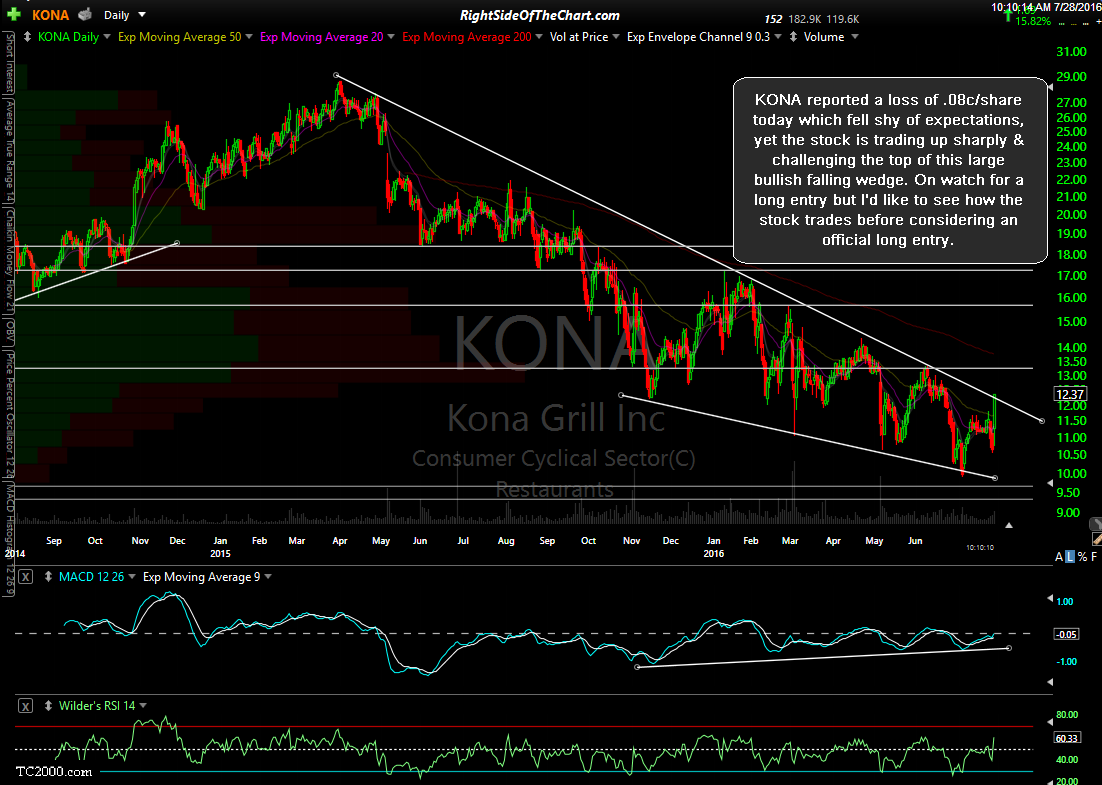

KONA (Kona Grill Inc) reported a loss of .08c/share today which fell shy of expectations, yet the stock is trading up sharply & challenging the top of this large bullish falling wedge. On watch for a long entry but I’d like to see how the stock trades before considering an official long entry, especially considering how far the stock has stretched today (16%) just to get to the top of the wedge. Unofficial trade idea for now but on watch for an objective or higher probability entry.

KONA Falling Wedge Pattern

Share this! (member restricted content requires registration)

4 Comments