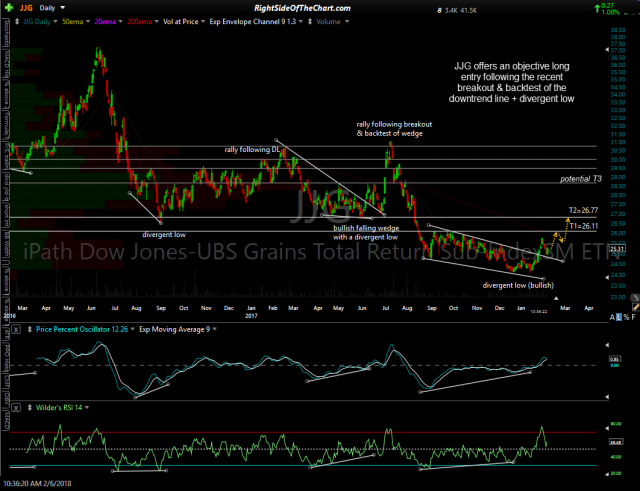

The JJG (UBS Grains ETN) long swing trade gapped up to open today at 26.78, 1 cent above T2, where any standing sell limit orders would have filled. This results in a 5.8% total or a 7% beta-adjusted gain in just 3 weeks for the trade as the suggested beta-adjustment for this relatively low-risk/low-volatility grain ETN (comprised of CORN, SOYBEANS & WHEAT futures) was 1.2 or 20% above a typical position size. Previous & updated daily charts below:

- JJG daily Feb 6th

- JJG daily Feb 13th

- JJG daily Feb 28th

click on the first chart to expand, then click anywhere on the right of each chart to advance to the next expanded image

I would highly suggest booking full profits on JJG here or within the next month as the ETN provider, Barclay’s series of iPath ETNs, has replaced JJG with a new similar grain ETN, JJGB, and will be delisting JJG on April 12th. Based on that fact, it is likely that liquidity in JJG will start to dry up as both existing holder of JJG as well as new traders & investors that want exposure to a grain ETN will opt for JJGB going forward. As this was the final target for JJG this trade & all associated posts will now be moved to the Completed Trades archives.