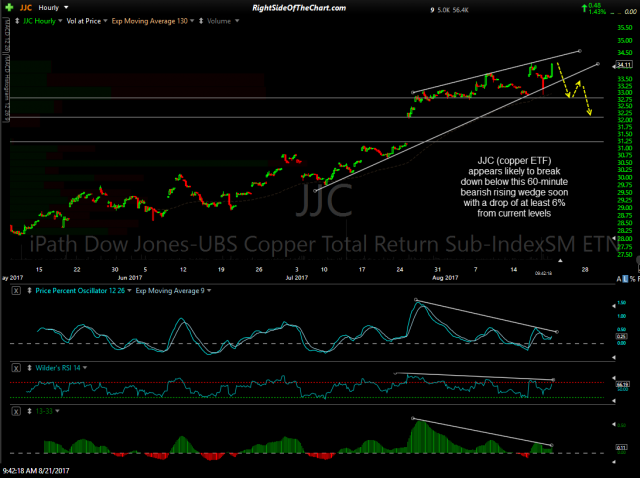

$COPPER (copper continuous futures contract) looks poised for a pullback off this overbought rally into resistance with negative divergences in place on the daily time frame while JJC (copper ETF) appears likely to break down below this 60-minute bearish rising wedge soon with a drop of at least 6% from current levels. I am considering adding JJC as an official trade idea although I plan to go through the charts of the mining companies with copper representing a fair amount of their production to see if those charts confirm or not & if so, find any attractive trading opportunities in the sector.

- $COPPER daily Aug 21st

- JJC 60-min Aug 21st

To be clear, I’m only looking for a relatively minor correction in copper prices. $COPPER has rallied over 40% since the bullish falling wedge breakout was highlighted back in July 2016, going on to breakout & backtest the primary downtrend line that has been highlighted since Aug 2015 as the next major buy signal. While I remain longer-term bullish, it does appear that a copper prices are likely to correct soon so the R/R for the near-term intermediate-term is skewed to the downside.