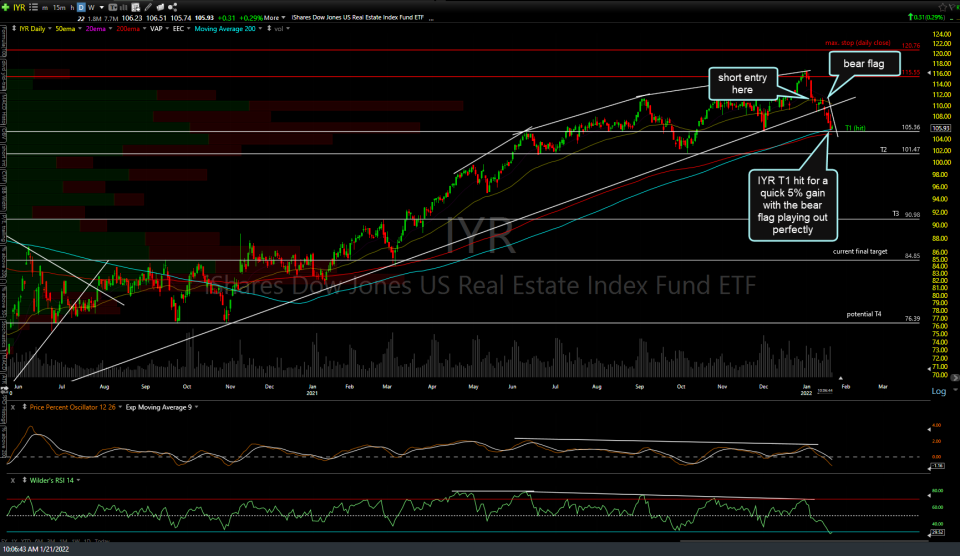

IYR (REIT sector ETF) has hit the first target, T1, for a quick 5% gain with the bear flag playing out perfectly. As the odds for a reaction off the initial tag of T1 are decent, swing traders could opt to book the quick profits and/or lower stops if holding out for any or all of the additional targets. Previous (Jan 7th) and updated daily charts below.

Likewise, SRS (-2x REIT sector ETF), which posted as an alternative proxy for shorting the REITs, has also hit & exceeded T1 & is good for a gain of about 12% so far, as IYR hits support. Previous & updated charts below.

Whether or not we get a reaction off this initial tag of T1 in IYR or not, more downside in the coming weeks to months still appears likely.