Although my recent preference for swing trade ideas has been to focus on individual stocks, sectors, & commodities with the most bullish (for longs) or bearish (shorts) technicals vs. trading the indexes, it appears that a compelling case can be made for either a hard or soft* short entry on IWM (small-cap ETF) at this time. (* a partial/fractional starter position with the intention of scaling in or adding to the position, ideally on weakness in IWM).

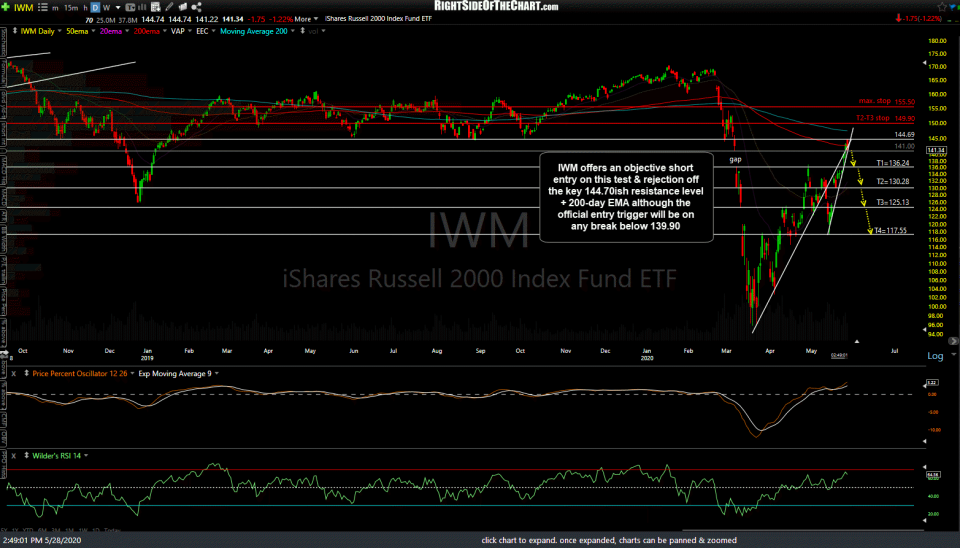

The price targets, as shown on the daily chart above, are T1 at 136.24, T2 at 130.28, T3 at 125.13, & T4 at 117.55 with the potential for additional targets, depending on how the charts develop going forward. The maximum suggested stop (if targeting T4 or beyond) is 155.50 while those targeting T1-T3 might consider a lower stop (T2-T3 suggested stop is 149.90). The suggested beta-adjusted position size for this trade is 1.0.

IWM has rallied back to test the key 144.70ish resistance level + 200-day EMA where it was (so far) rejected impulsively today. While shorting a bounce back to a solid resistance level on a security that is clearly in a bear market, such as IWM, is certainly objective, due to the fact that we have yet break below the recently highlighted support levels on QQQ & the majority of the FAAMG stocks, the official entry trigger for IWM will be on any break below 139.90 as that will have clearly taken it below this 60-minute rising wedge pattern.

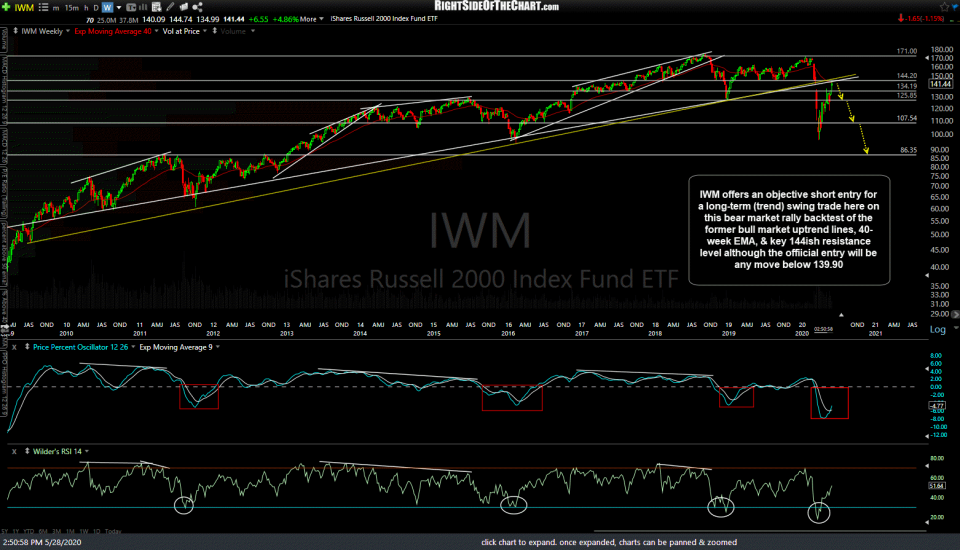

The 10+ year weekly chart below helps to support the case for a short on IWM as it has rallied into the previously broken bull market uptrend lines as well as the key 144-145ish resistance level & the 40-week EMA. The PPO is buried deep into bearish territory (well below the zero line) as the weekly RSI has bounced back to the 50 midpoint, which often delineates bullish & bearish trends, acting as support when tested from above & resistance when tested from below (+/- 5 points or so).

As always, pass if this trade does not mesh with your outlook for the small-caps, your risk tolerance, trading style, or comfort level. I’ll try to follow up with some comparable target for one or more of the inverse (short) ETFs for the Russell 2000 such as RWM (-1x), TWM (-2x), and TZA (-3x).