While I still have a high degree of confidence that all 4 former price targets on IWM will be hit in the coming months, the official trade was stopped out at yesterday’s close of 131.60 for a relatively small loss of 3.16%. Pending decent evidence of a reversal IWM may be added back as an official short trade idea again soon.

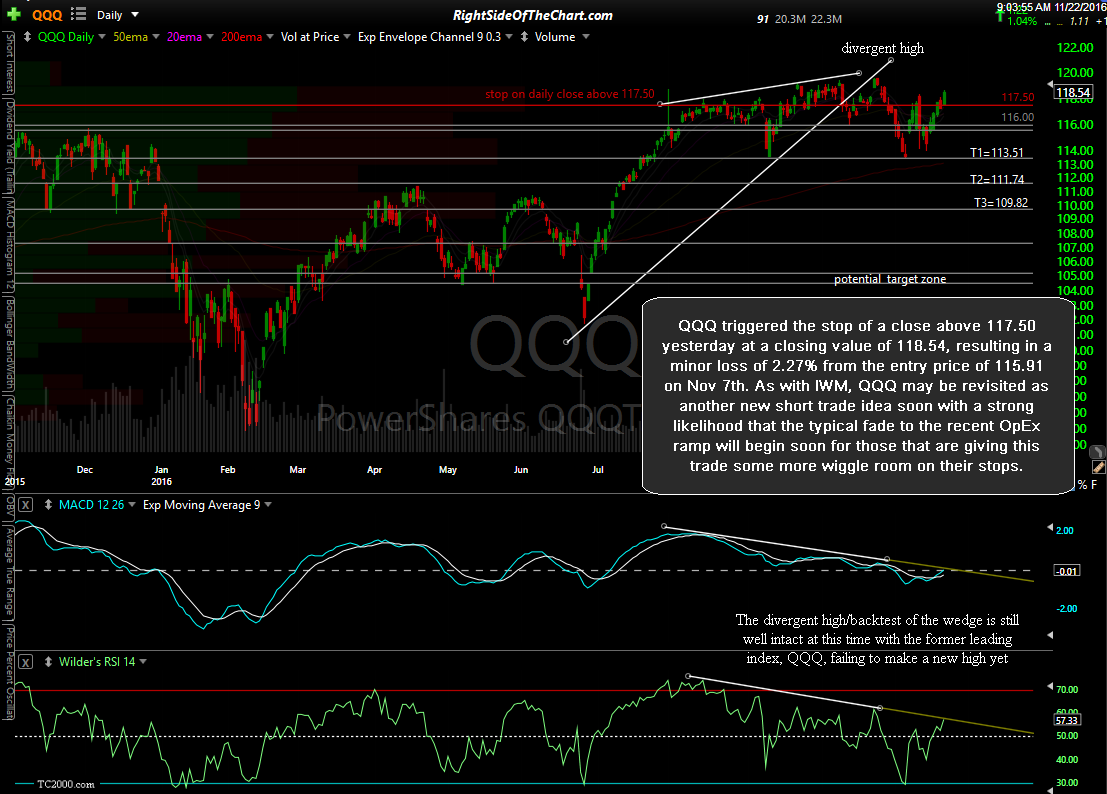

QQQ triggered the stop of a close above 117.50 yesterday at a closing value of 118.54, resulting in a minor loss of 2.27% from the entry price of 115.91 on Nov 7th. As with IWM, QQQ may be revisited as another new short trade idea soon with a strong likelihood that the typical fade to the recent OpEx ramp will begin soon for those that are giving this trade some more wiggle room on their stops. The divergent high/backtest of the wedge is still well intact at this time with the former leading index, QQQ, failing to make a new high yet.