I had intended to cover the charts of INTC (Intel Corp.) in today’s video but skipped over it. INTC is the largest semiconductor stock & industry leader with the potential to set the tone for both the semiconductor sector and possibly the larger technology sector as they report earnings after the market close today.

Starting out with the big picture via the 11+ year weekly chart below, the stock shows a pretty clear pattern of double-digit corrections following divergent highs. The big question right now: Was the 37% drop off the most recent weekly divergent high, which came in the form of just a single wave down, the end of the correction or will there soon be another leg down to come?

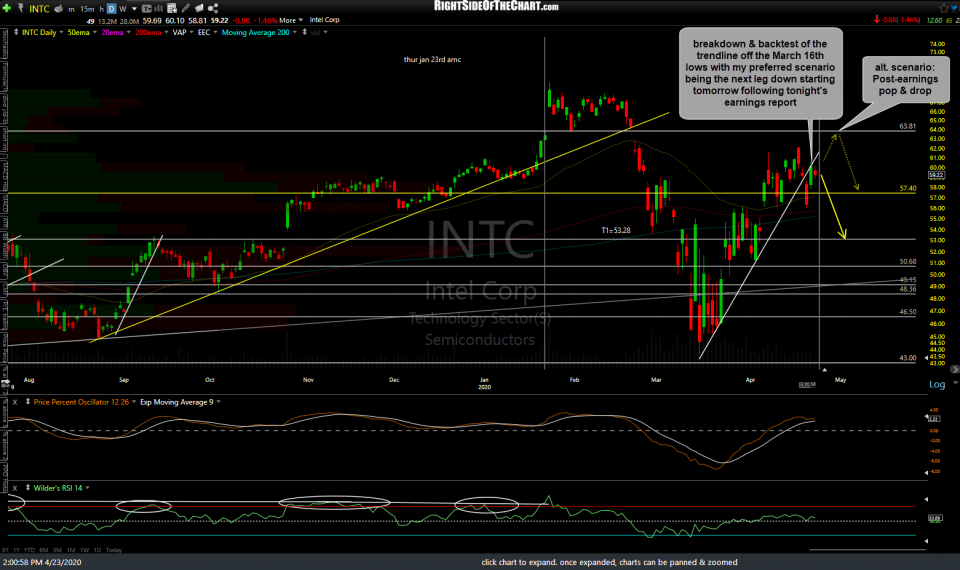

Zooming down a notch to the daily time frame, Intel recently broke below & backtested of the trendline off the March 16th lows with my preferred scenario being the next leg down starting tomorrow following tonight’s earnings report and an alternative scenario of a post-earnings “pop & drop” or ‘gap & crap” (a rally into or near the 62-64ish resistance zone followed by a reversal & significant drop from there).

Taking it down a notch further to the 60-minute chart, my preferred scenario meshes with that on the daily chart above: INTC earnings disappoint, triggering a breakdown below this 60-minute bearish rising wedge pattern tomorrow with the alternative (but still bearish, just a tad ‘less bearish’) scenario of one more thrust up within this bearish rising wedge pattern before reversing & breaking down below the wedge, thereby triggering a sell signal & objective short entry or add-on to an existing short taken up or near the resistance zone just overhead (or even a speculative/aggressive short position taken here in front of earnings).

Any rally & solid close much above 64 and I’ll have to give the stock some credit, especially if it can take out the 68ish resistance level & the previous ATH not far above that. I plan on waiting to see how INTC trade tomorrow & possibly into next week before deciding whether or not to add one of the semiconductor sector ETFs back as an official short trade idea. Should INTC reverse & start a new leg down soon, my longer-term swing targets would be (roughly) 42.60, 38.30, with the potential for additional targets, depending on how the stock, the semiconductor sector, and the broad-market looks if & when INTC gets anywhere close to those levels.