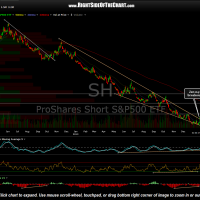

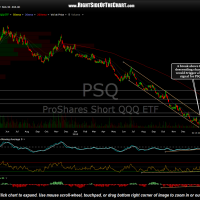

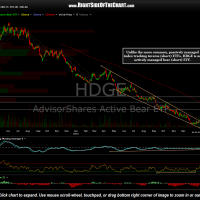

Here are a few bearish/short ETF’s for those looking for either a pure-play short on the U.S. equity markets as well as for those who might be looking to hedge a portfolio of longs, particularly in an IRA where shorting of individual stocks is prohibited. I am not a fan of the 2x & especially the 3x leveraged ETFs (SPXS, SQQQ, TZA, etc..) due the decay suffered when holding these instruments for more than a day or so. The first three ETFs below (SH, PSQ & RWM) are the 1x inverse (short) tracking ETFs for the S&P 500, Nasdaq 100, & Russell 2000 Indexes. Unlike those passively managed index tracking ETFs, HDGE is an actively managed bearish ETF which shorts the stocks of companies that they deem bearish from a fundamental perspective (click here for more information on HDGE).