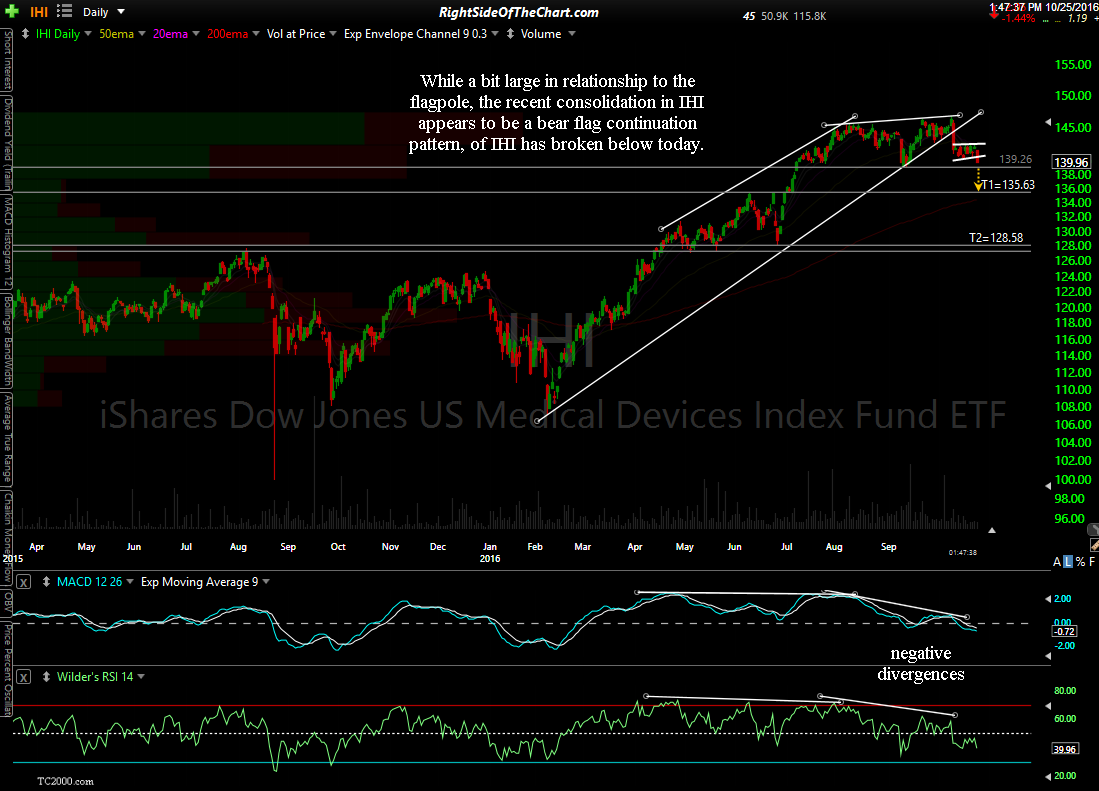

I’m still catching up on the charts but wanted to share what stands out so far. The charts of the broad markets are still a mess, churning around in a very sloppy, difficult-to-trade sideways range. I’ll continue to post updates on an significant developments but it seems to be that the best trading opps at this time are with individual stocks and sectors. Again, I haven’t gone through all the charts that I plan to but so far, the recently highlighted medical device sector (eft: IHI) appears to have just broken down below what appears to be a bearish continuation pattern & is coming up on support around 139.25 although I’d expect that level to get taken out with a continued move down to the 135.55 area.

The charts of IHI, along with the following stocks below (and a few others) were all covered in last week’s Medical Device Sector Analysis & Trade ideas video. EW is one of the more promising short setups covered in last week’s video. A break below the 112.25ish level would likely trigger at least a backfill of the July 27th gap & quite possibly a move down to the 94 area.