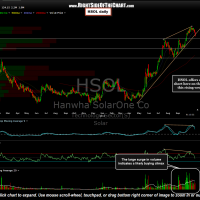

HSOL is breaking below this bearish rising wedge pattern following the most recent thrust higher on what appears to be a possible buying climax. I have noted a support level (S1) that comes in around the 4.25 area which may or may not produce a reaction (pause or bounce) in the stock. One could either short a full position here or take a starter position, adding to the trade if & when prices move below the s1 level. Targets are marked on this daily chart although the exact suggested buy-to-cover levels along with the suggested stop(s) will follow asap.

HSOL is breaking below this bearish rising wedge pattern following the most recent thrust higher on what appears to be a possible buying climax. I have noted a support level (S1) that comes in around the 4.25 area which may or may not produce a reaction (pause or bounce) in the stock. One could either short a full position here or take a starter position, adding to the trade if & when prices move below the s1 level. Targets are marked on this daily chart although the exact suggested buy-to-cover levels along with the suggested stop(s) will follow asap.

As with the GTAT short trade posted earlier today, HSOL is a component of the solar ETF, TAN. Just as with investing, proper diversification amongst trading positions is critical to one’s long-term success. If one were to have 10 equal-weighted positions in their trading account with 5 of those positions in any one sector, such as the solar stocks, he/she would be extremely over-weighted in that sector and exposed to an unacceptably high level of risk, should the sector move against him/her. Personally I prefer to go long (or short) the most bullish (bearish) stocks within a sector vs. buying (shorting) the entire sector via the tracking ETF). When doing so, I will first calculate how much exposure I want to the sector and then figure my position sizing base on how many individual stocks within the sector that I plan to trade in order to make up my overall exposure to the sector or industry. Currently, I am focused on the following individual components of TAN as short candidates: GTAT, HSOL, JASO & SPWR but that list may be extended.