I wanted to add some follow-up comments regarding the two recently posted charts of the $OEX, both the 20 year weekly chart highlighting the time symmetry of the previous bull markets as well as the weekly chart posted earlier today highlighting the primary uptrend line of the current 5+ year bull market. Weekly charts spanning years or even decades are primarily used to identify secular and cyclical trends (bull & bear markets). Regardless how close those charts might appear to be signaling a primary trend change, those signals, or a least a break below the bull market uptrend line has not happened yet and could take months, possibly even years. Remember, support is support until broken and although the divergences currently in place indicate waning momentum and warn of a likely correction, sometimes divergences are negated when prices continue to climb, thereby eventually causing the indicators & oscillators to make new (higher) highs.

When trying to identify a primary trend change there is no single technical event that signals a change from bull to bear market, other than a price drop of the commonly used 20% figure. There is a common saying that market tops (and bottoms) are a process, not an event. That statement can be interpreted in several ways, one of which I feel strong about is a that major tops and bottoms are defined by a series of technical events, not any single event such as a trendline break or crossover of a moving average pair. Using technical analysis to determine when a primary trend chance has taken place can be compared to how a district attorney’s office will build a case against a defendant accused of a crime. The prosecutor will work to show the courts not just one piece of evidence, rather a series of facts and physical evidence that helps to prove, without a reasonable doubt, that the accused is guilty.

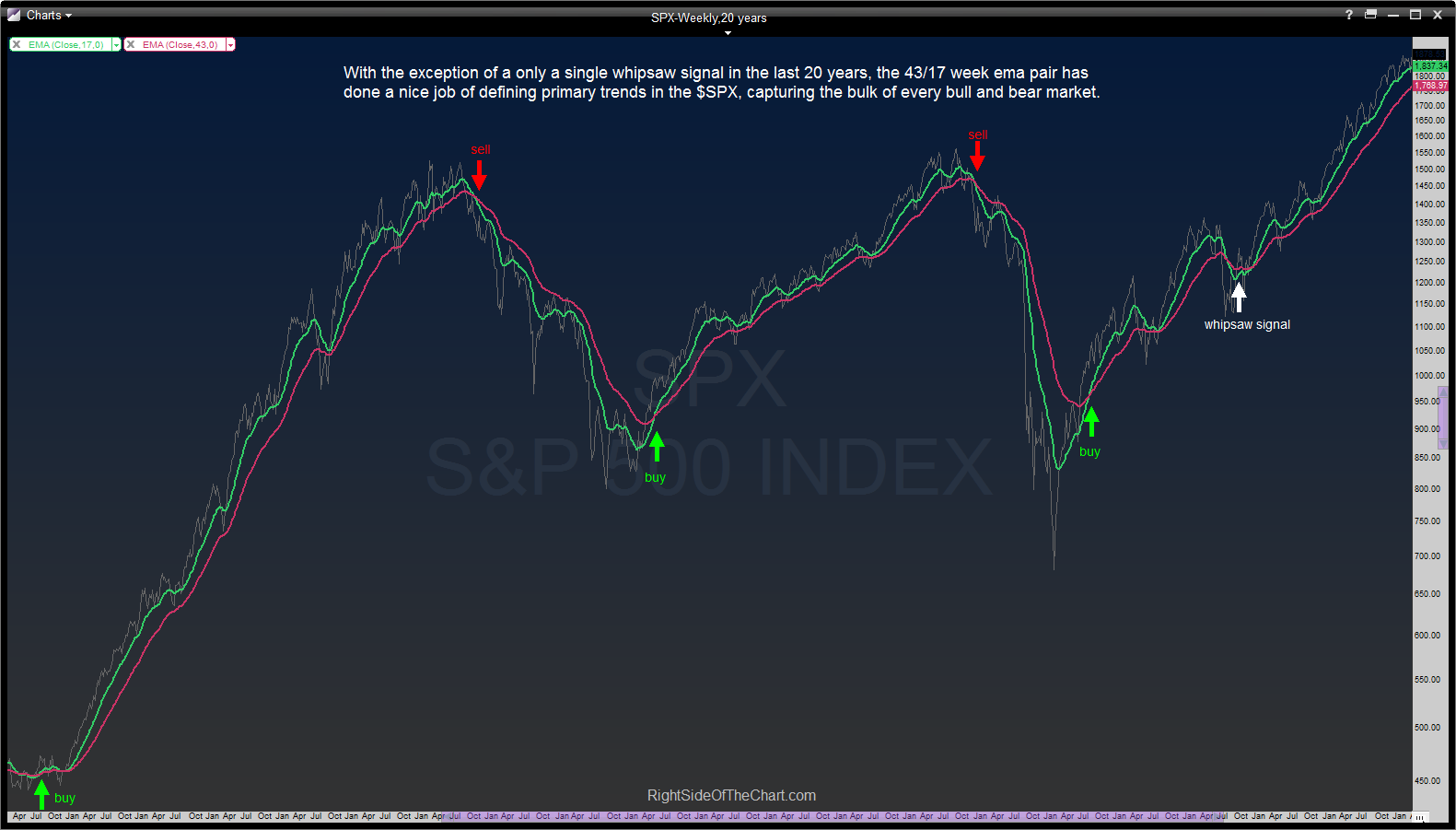

Expanding on that analogy, one of the first steps in determining whether the primary trend in the market has changed would be a break of that well-defined uptrend line on the $OEX presented earlier today. Had I only been able to connect two or three reaction lows with that trendline, I would not have even mentioned it or given it much of a weighting in my analysis. However, with about a half-dozen clear reactions off that support line since it’s inception over 5 years ago, I would place a considerable emphasis on any solid break or weekly close below that level. With the $OEX currently trading just mere percentage points above that trendline, if prices did breakdown soon it might provide us with an early heads-up on a potential trend reversal. However, that would only be one piece of “evidence” and just like a defendant is innocent until proven guilty, a primary market trend should always be respected until there is a preponderance of evidence to the contrary. There are numerous metrics employed by technicians to help predict or determine trend changes but following a break of the primary bull market uptrend line, not just on the $OEX but most or all other major US indices as well, I would then look for my weekly 17/43 ema pair (below), and eventually my monthly 6/10 ema pair trend indicators to move to sell signals.

What does all this mean? Should a trader refrain from shorting stocks until we have sufficient evidence that a new bear market has taken root? The answer to that question depends on who is asking it. Personally, I’m just as comfortable shorting stocks in a bull market as I am in a bear market, just as I love going long stocks in bear markets… at the right time that is, typically during the notoriously fast & powerful bear market rallies. Another factor to consider is one’s time frame. Investors, trend traders and longer-term swing traders might choose to only align their trades with the intermediate or long-term trend while more active swing traders might opt to focus on the shorter-term trends primarily using daily & intraday charts in their analysis. Many traders, like myself, fall under both categories with accounts for both active trading as well as long-term accounts such as IRAs.

Those new to trading or Right Side of the Chart should also understand the importance of defining one’s trading style and time frame in order to focus on what is relevant to your trading and tune out the “noise”. If you are a long-term trader or investor, then you might not want to focus too much on the 15 & 60 minute charts posted here other than maybe to help time the entry or exit on a position. Active swing traders with expected holding periods measured in days, weeks or just a few months need not be overly concerned with the weekly charts or monthly charts other than noting the intermediate & longer-term trend changes. One example where this may be useful is in determining price targets. Most trade ideas at RSOTC list multiple price targets. When taking a counter-trend trade (e.g.-shorting during an intermediate or long-term uptrend), I will often enter a trade with the intention of booking profits at one or more of the earlier targets. However, if during that trade, we get enough technical evidence to suggest that the trend has changed to bearish, then I might opt to extend my price target to the final target (possibly adding additional targets to the trade as well).

Finally, remember that that there are times where the trend on various time frames is just not clear. For example, right now we still have an unmistakable short-term downtrend in the $NDX/QQQ that has been in place for the last 7 weeks as evidenced by the Q’s making a series of lower lows and lower highs. However, that is not the case with the $SPX/SPY which went on to print a marginal new high earlier this month after topping along with the Q’s back in early March. Although the SPY recent came under some selling pressure along with the Q’s, the SPY is now just mere basis points away from a new all-time high. We also have a mixed bag on daily 20/50 ema pair intermediate-term trend indicator with the QQQ on a sell signal since April 8th but the SPY on still on a buy signal going all the way back to Dec 2012 (barring a very brief whipsaw signal in early Feb of this year). The Bottom line is the near-term technical picture is not very clear at this time and as such, trading is likely to be very difficult for all but the most nimble traders. One of the most costly lessons I learned early on as a full-time trader was when to actively engage the market and more importantly, when to keep things light while patiently waiting for the chart to confirm the next favorable R/R entry.