HOLX (Hologic Inc) will be added as an Active Short Trade here while trading at the top of this bearish rising wedge pattern on the daily time frame. This entry should be considered an aggressive, counter-trend trade as HOLX is in an unmistakeable & powerful uptrend while trading at new multi-year highs. With that being said, I believe a trend reversal in HOLX is imminent as the stock approaches key resistance defined by the January 2008 all-time highs in the stock. That all-time high set in the beginning of 2008 was 36.44 and with the stock currently trading less than a point below that level, I personally opted to establish a starter position here in anticipation of a trend reversal.

- HOLX daily May 29th

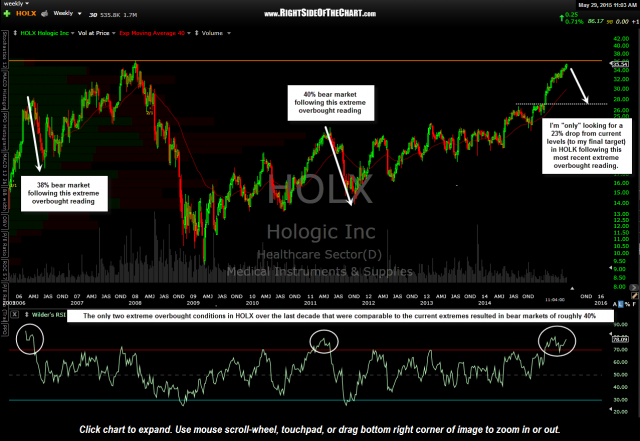

- HOLX weekly May 29th

As the 10-year weekly chart above highlights, HOLX has recently reached overbought levels only seen twice before over the last decade, with both previous extremes followed by bear markets of roughly 40%. At this time, I’m “only” looking for a drop of about 23% from current levels to my final target, T3 at 27.44. Again, shorting here with prices still inside the wedge and yet to even remotely show any signs of a reversal or even a pause in the strong uptrend should be viewed as an aggressive trade. A more conservative entry would come if/when prices break below the wedge pattern, which is less than 3% below current levels.

My plan is to establish a short position here, adding on either a continued move higher to challenge those previous 2008 highs and/or bringing the trade to a full-position once/if prices break down below the wedge pattern. Looking for a drop of over 8 points to the final target, a stop on a weekly close above 37.55 (the official stop for this trade) would offer a 4:1 R/R based on an entry at current levels. For those only targeting T1 or T2, consider adjusting your stops accordingly using an R/R of 3:1 or better.