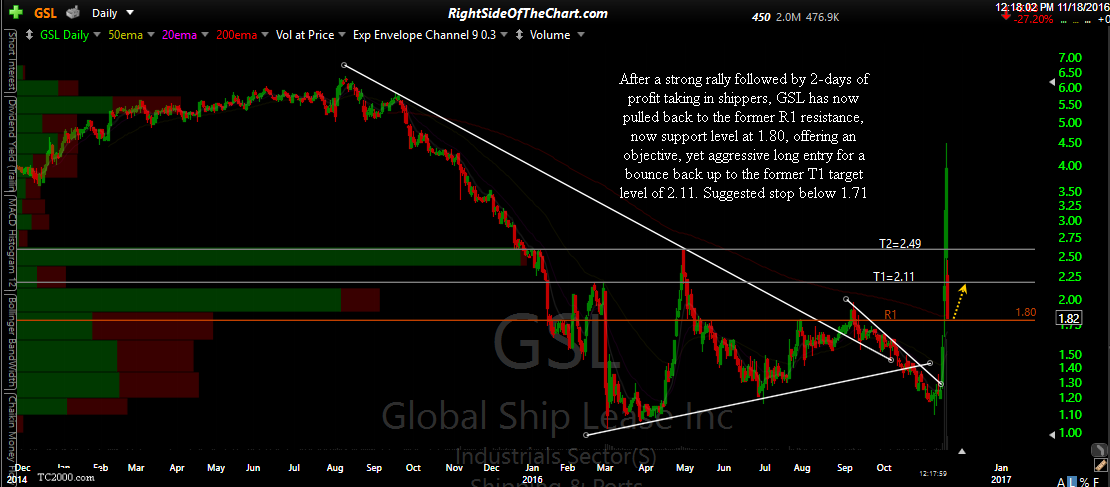

After a strong rally followed by 2-days of profit taking in shippers, GSL (Global Ship Lease Inc) has now pulled back to the former R1 resistance, now support level at 1.80, offering an objective, yet aggressive long entry for a bounce back up to the former T1 target level of 2.11. Suggested stop below 1.71 with a suggested beta-adjustment of 0.50.

Normally, I might only post such an aggressive & relatively short-term trade (the expected holding period until profit target or stop is hit would is within a few trading sesssion, most likely under 1 week) within the trading room. However, market conditions over the last several months have been anything but normal, with the major stock indices trading in a relatively tight sideways trading range while essentially going nowhere. Until the market makes a definitely breakout above or below the recent multi-month trading range, I might post more of these “quick” swing trades such as GSL, where I’m only looking to trade a quick bounce off support or pullback from resistance on a trade that might only last hours or days.

That isn’t to say that there haven’t been any trading opportunities, as there has been. While the market has ground around mostly sideways for months now, there has been a lot of sector rotation & very clear bullish & bearish trends & swing trading opps within individual stocks & sectors. The sloppy, sideways price action in the market is one reason that I once again temporarily pulled the stops on the QQQ short trade as well as IWM yesterday (a wise move so far with QQQ falling back below the 117.50 level as of now).

I realize that some traders use very rigid & discipline trading rules but I’ve always found it best to adapt your trading style as well as being open to modified your trading plan for individual position depending on market conditions, which can range from the markets clearly trending in one direction with little give-back for weeks or even months on end, to choppy-sideways trading which has the tendency to run any normal stop-loss order on both long & short trades alike, even if the the bullish or bearish patterns remain intact & those trades ultimately go on to hit their profit targets.