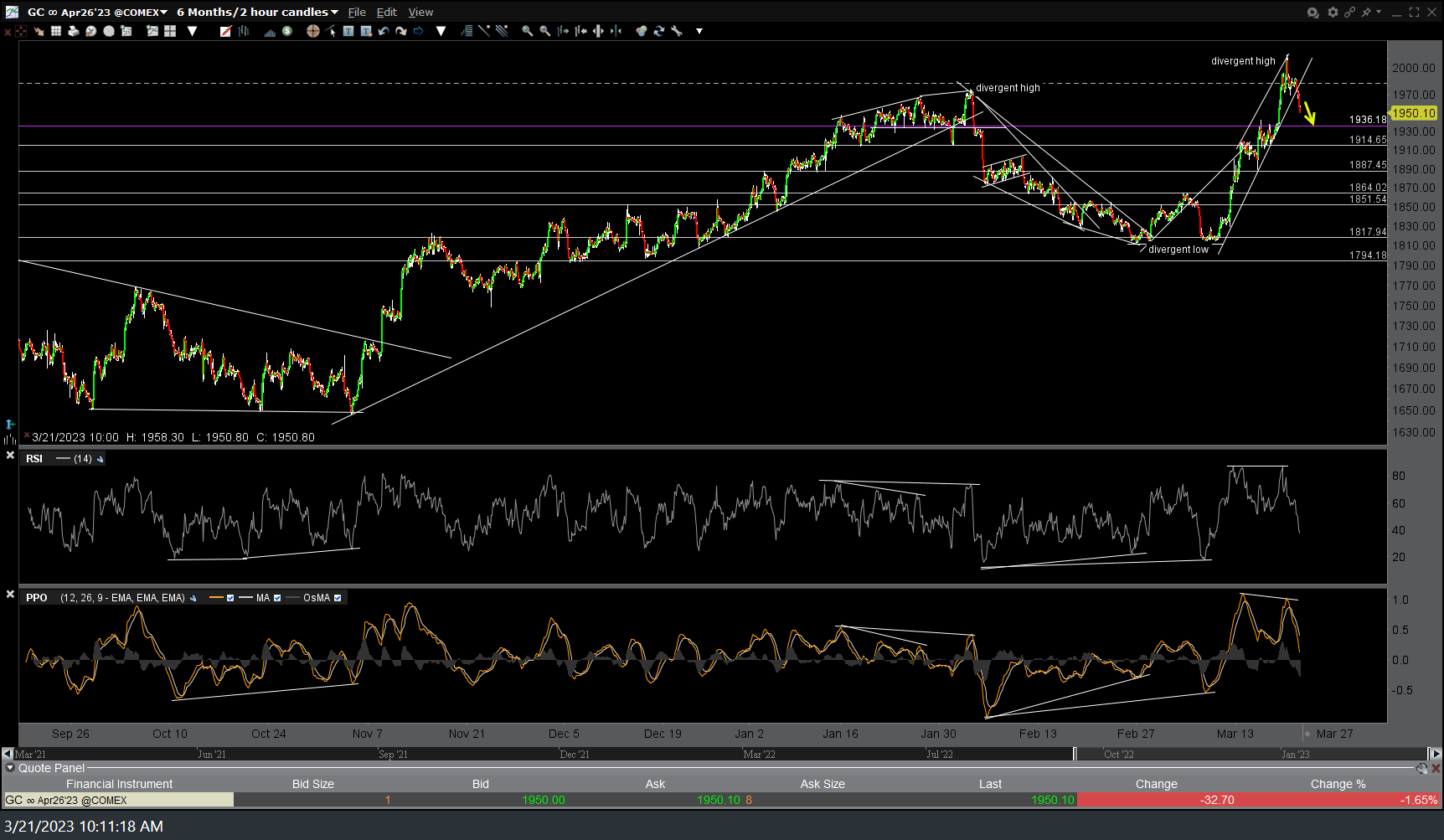

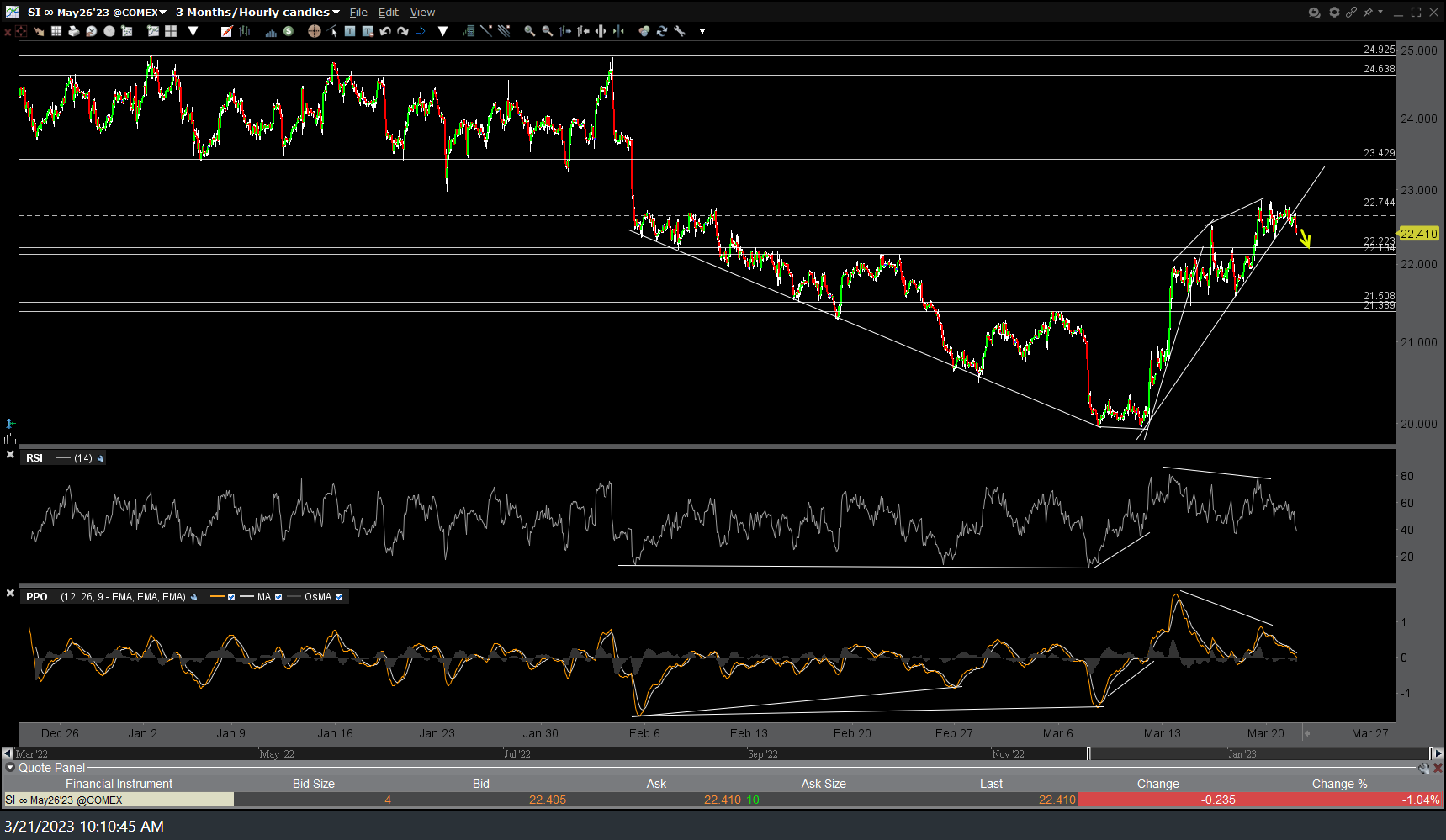

Both /GC (gold futures) and /SI (silver) triggered sell signals on trendline breaks following the recent divergent highs & rallies into resistance. I will say that taking positions in any interest-rate/US Dollar sensitive assets such as the precious metals just in front of a widely anticipated FOMC rate decision runs a much higher chance of proving to be a whipsaw although I suspect gold & silver will continue to fall to at least the 1936ish & 22.20ish support levels/targets, respectively. 120-minute chart of /GC & 60-minute chart of /SI below (I took screenshots of both a little earlier but they are still trading around the same levels now).

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}