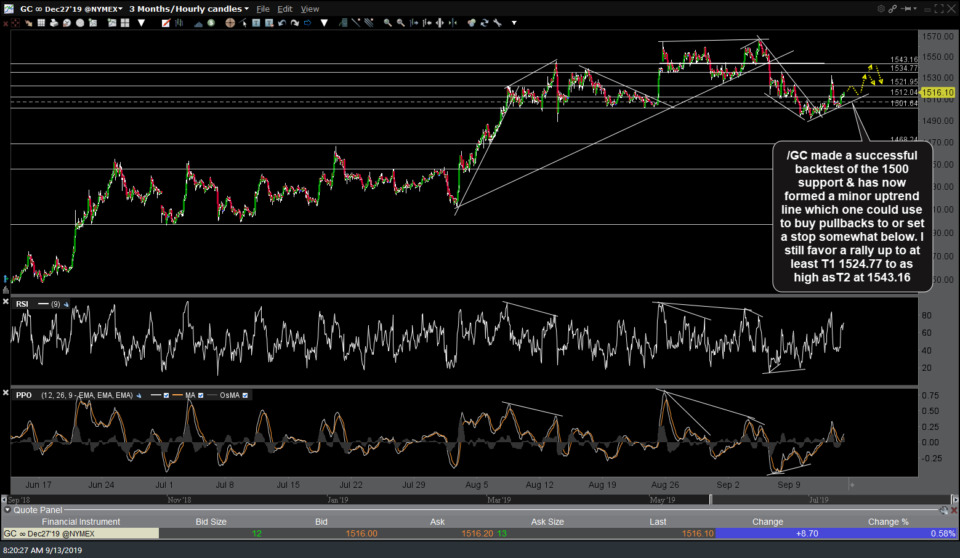

/GC (gold futures) made a successful backtest of the 1500 support & has now formed a minor uptrend line which one could use to buy pullbacks to or set a stop somewhat below. I still favor a rally up to at least T1 1524.77 to as high asT2 at 1543.16.

Likewise, GLD (gold ETF) is trading just above uptrend line + the 140.78 gap support & looks likely to rally back up to any or all of the 3 resistance levels shown above on this 120-minute chart.

/PL platinum continues to walk up the minor uptrend line once again approaching the 965.67-967.94 target zone.

So far, /SI silver has done a solid job of holding above the 18.06 support level mentioned in yesterday’s video as my preferred level for it to hold above on any pullbacks. Essentially, these same three precious metals that served as effected hedges to my equity index shorts when held as short positions off the early Sept highs, due to the clearly bearish technicals back then, have recently been serving as effective hedges once again although as long positions, due to the current bullish technical posture of these charts.

Note: As I was composing this post (since taking the screenshots above), all 3 metals took a sharp leg down which has brought them all back down to the minor uptrend lines or price support levels mentioned above, thereby offering another objective long entry here with stops somewhat below. (/GC just kissed 1504.2, /SI 18.02 & /PL 954.30)