With the recently highlighted multiple sell signals on the GLD (gold ETF) daily chart (i.e.- bearish engulfing candlestick + Island Cluster Top), GDX (gold miners ETF) also offers another objective short entry or add-on with plenty of downside to my initial & minimum swing targets. 60-minute chart below.

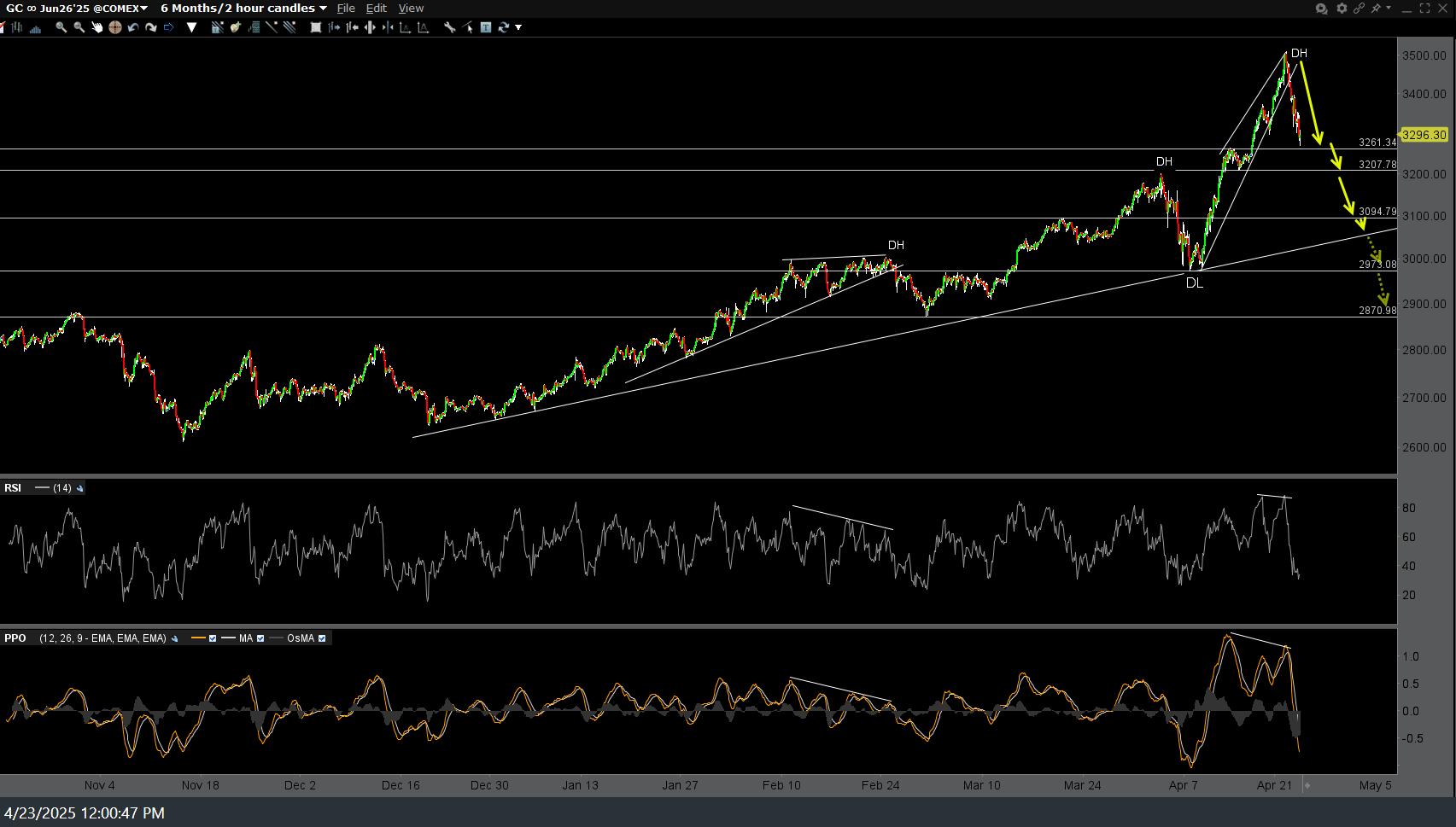

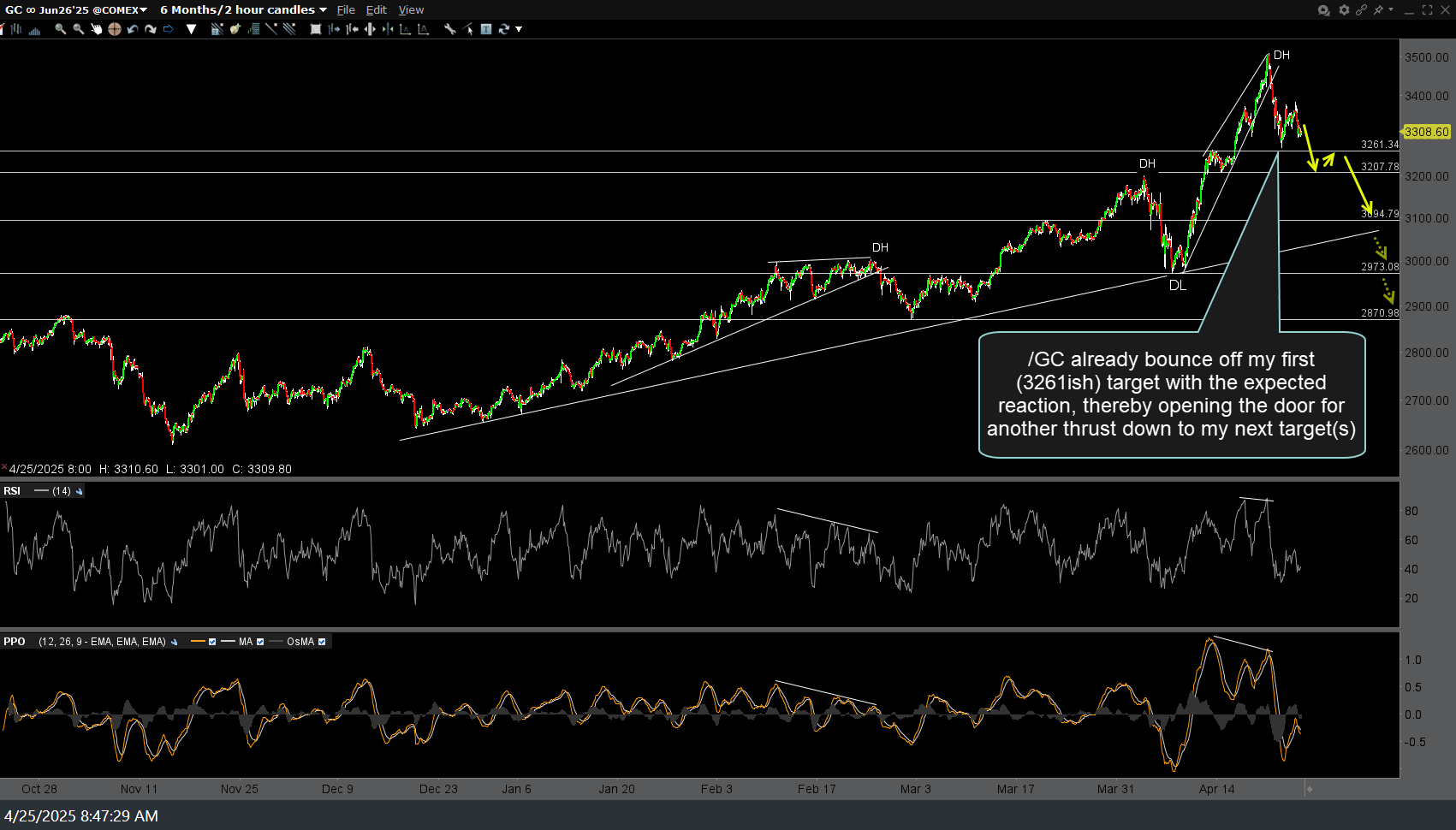

/GC (gold futures) already bounce off my first (3261ish) target with the expected reaction, thereby opening the door for another thrust down to my next target(s). Previous (April 23rd/Wednesday) and updated 120-minute charts below (as always, arrow breaks denote likely reaction levels).

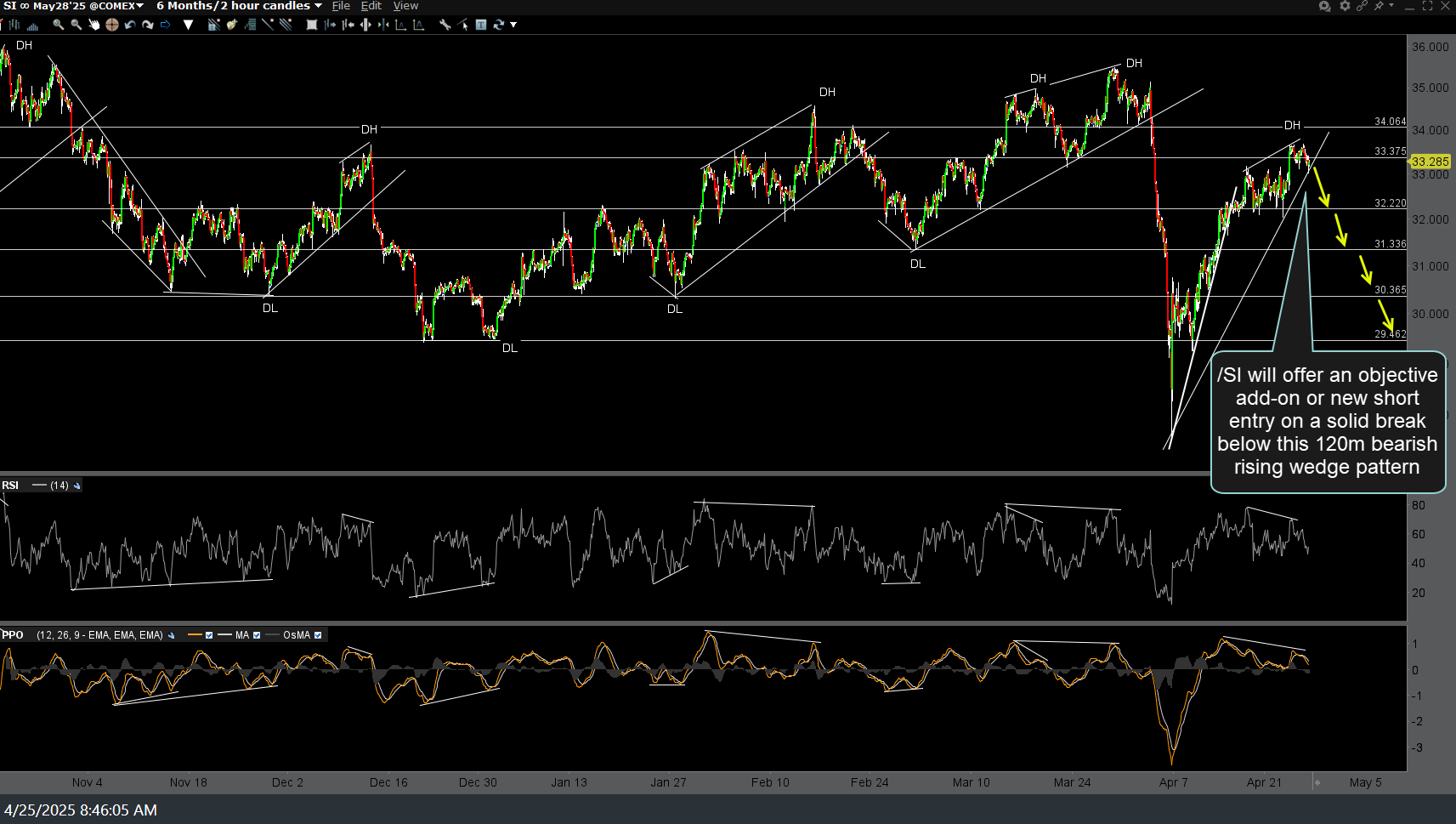

Likewise, /SI, silver futures or SLV, (+1x silver ETF), ZSL (-2x ETF), etc… will offer an objective add-on or new short entry on a solid break below this 120-minute bearish rising wedge pattern.