/GC (gold futures or GLD, gold ETF) sell signal triggered/objective short add-on or new entry on this 60-minute bearish rising wedge breakdown.

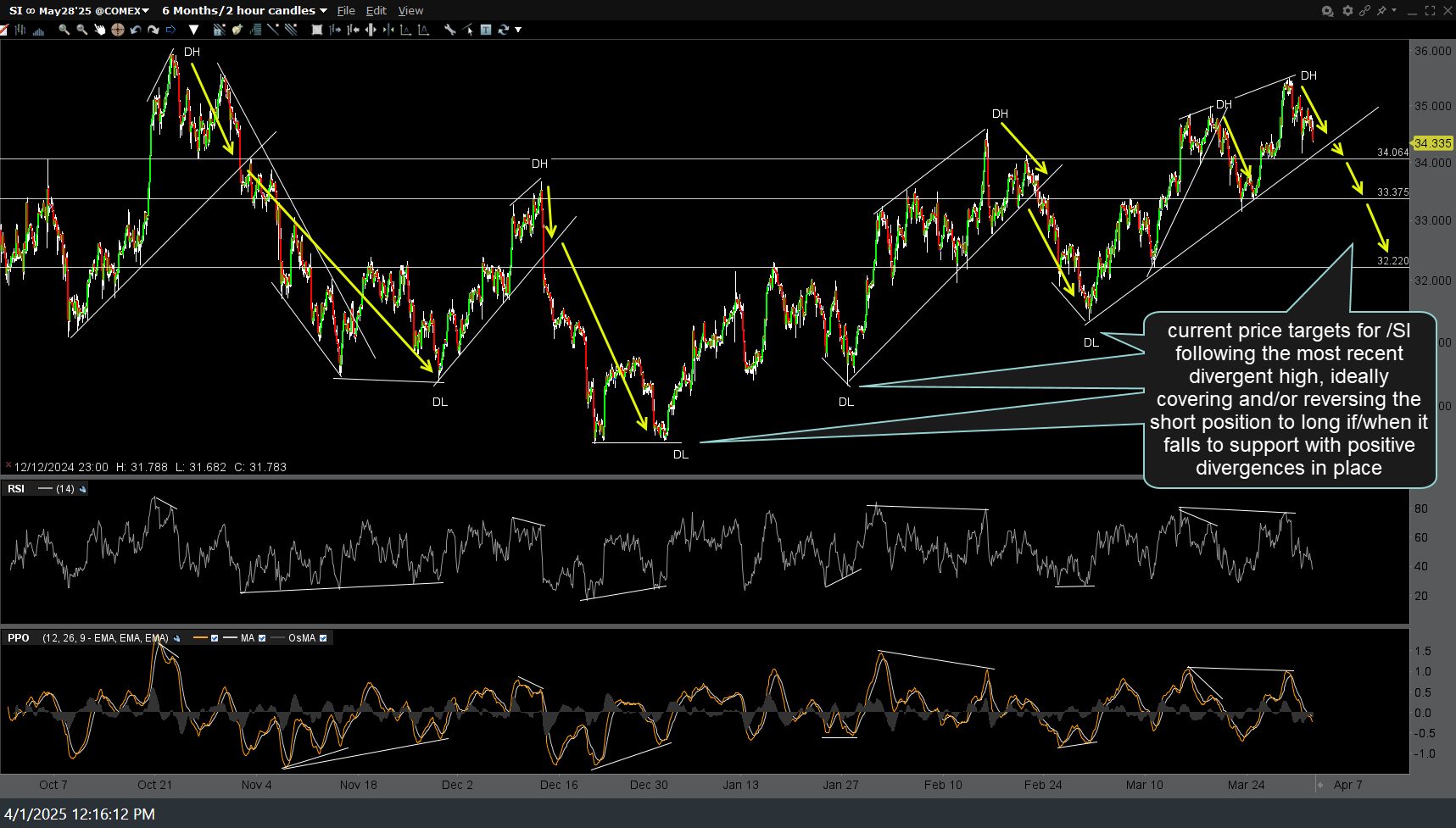

The (6-month) 120-minute chart below has my current price targets (arrow breaks) for /SI (silver futures) following the most recent divergent high, ideally covering and/or reversing the short position to long if/when it falls to support with positive divergences in place.

The next sell signal on GDX (gold miners ETF) to come on a solid break below this 60-minute uptrend line & again below the 44.55 price support just below it (no longer waiting for the break below 276.90 in GLD, which hasn’t happened yet as GLD fell to, trading on, & then bounced off that support level shortly after the last update on GDX…hence the reason for the marginal new high in the metals & miners). Previous (March 26th) & updated (with an new potential deeper target) 60-minute charts below.