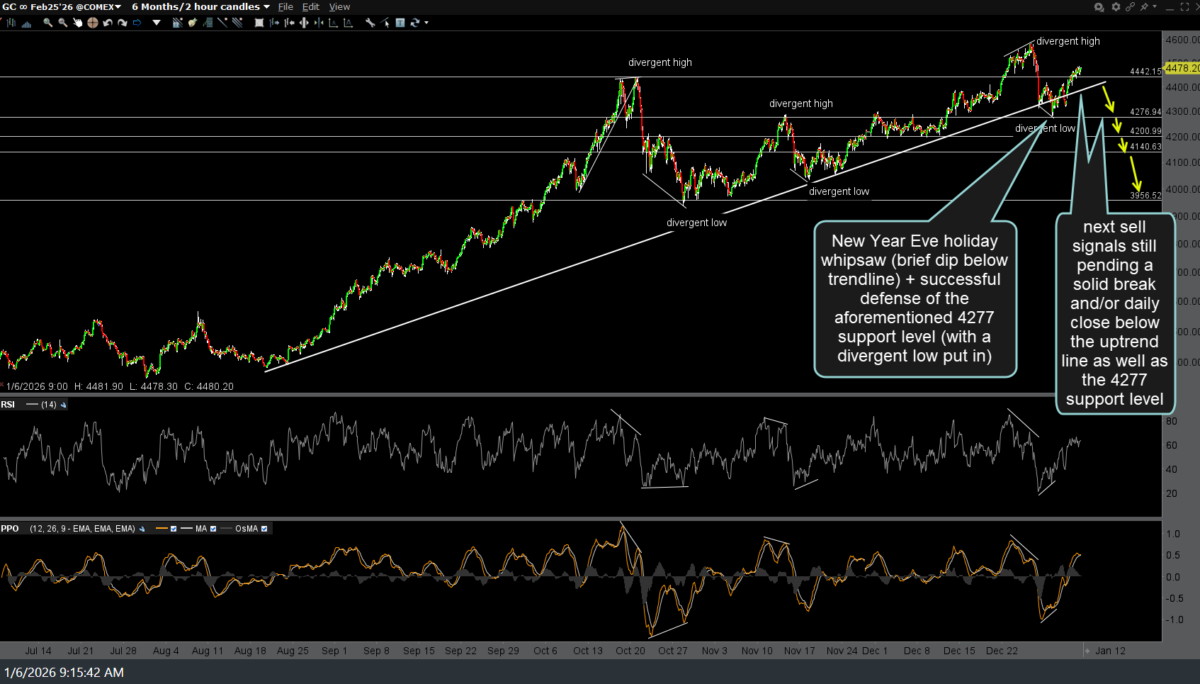

No big surprise: The low-volume “take it with a big grain of salt” breakdowns on gold & silver on the Dec 31st New Year’s Eve holiday trading session turned out to be a whipsaw (brief dip below trendline) as well as a successful defense of the aforementioned 4277 support level (with a divergent low put in to boot), with /GC (gold futures) immediately regaining the uptrend line after reversing of that 4277 B.O.D. support level. The next sell signal for /GC is still pending a solid break and/or daily close below the uptrend line, as well as the 4277 support level. Previous (Jan 2nd) and updated 120-minute charts below.

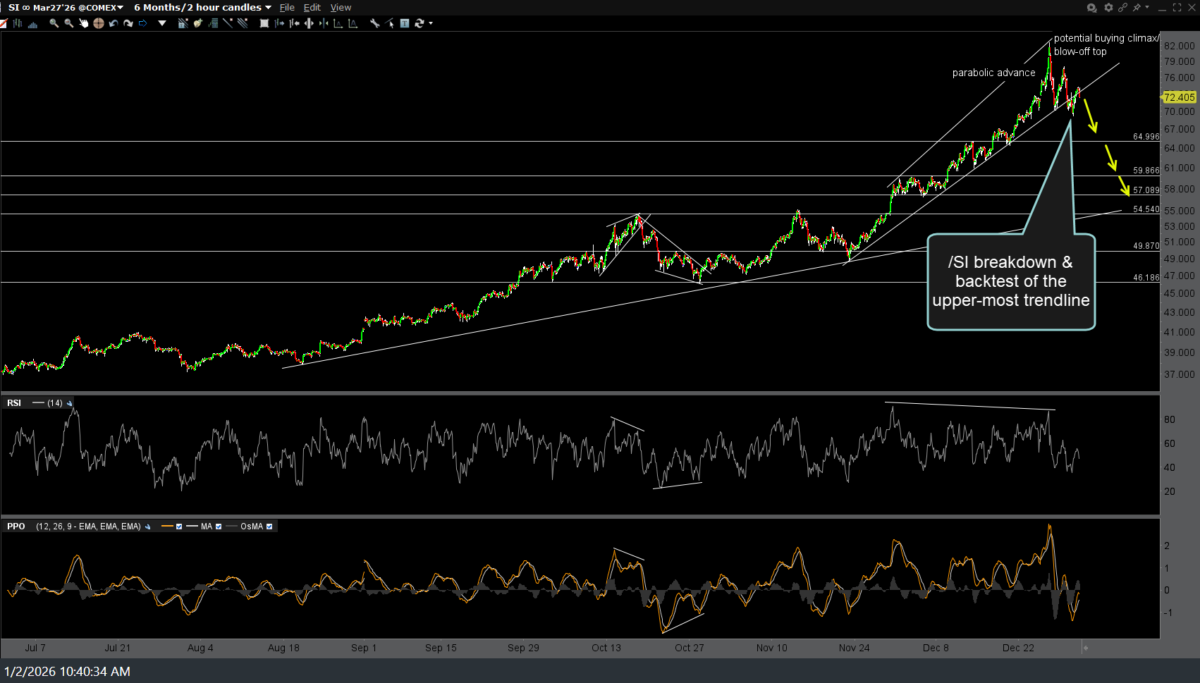

Ditto for /SI (silver futures), with a New Year’s Eve brief whipsaw dip below & followed by a recovery back above the trendline with the next sell signal still pending a solid break and/or daily close below it. Previous (Jan 2nd) & updated 120-minute charts below.

Bottom line: While both gold & silver remain below their recent highs, my preference would be not to add to (but sit tight on existing) or initiate any new short position on the metals and/or miners until & unless the aforementioned sell signals in both are triggered, especially now that the low-volume whipsaw-prone holiday trading sessions are behind us.