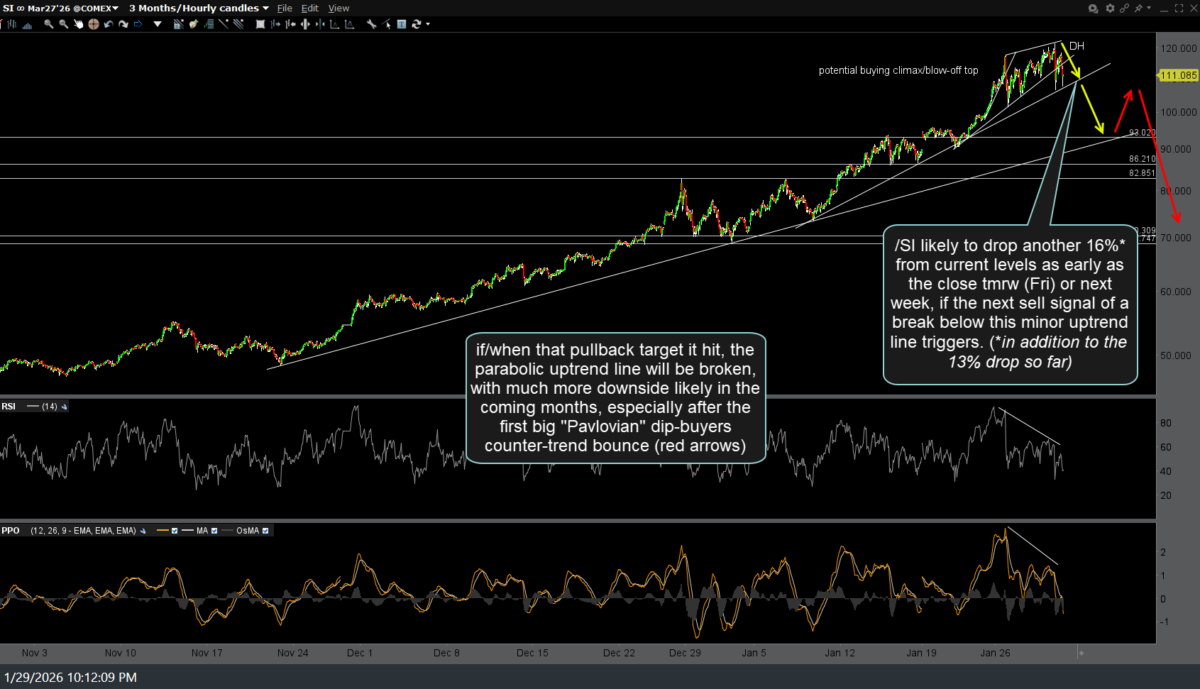

I figured I’d fire this one off before turning in for the evening, as these key support levels & next potential sell signals in gold & silver could trigger any time now, possibly overnight. /SI (silver futures) appears likely to drop another 16%* from current levels as early as the close tomorrow (Fri) or next week, if the next sell signal of a break below this minor uptrend line triggers. (*in addition to the 13% drop so far). 60-minute chart below.

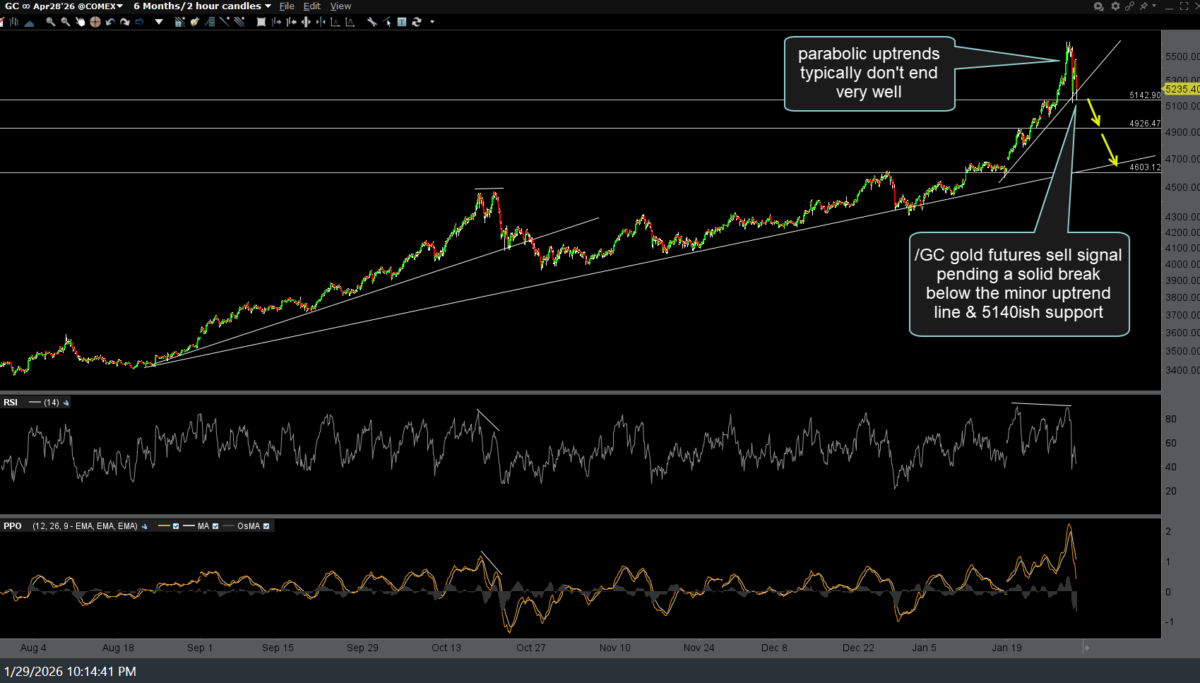

As I often say, parabolic uptrends typically don’t end well: /GC (gold futures) sell signal pending a solid break below the minor uptrend line & 5140ish support on this 120-minute chart.

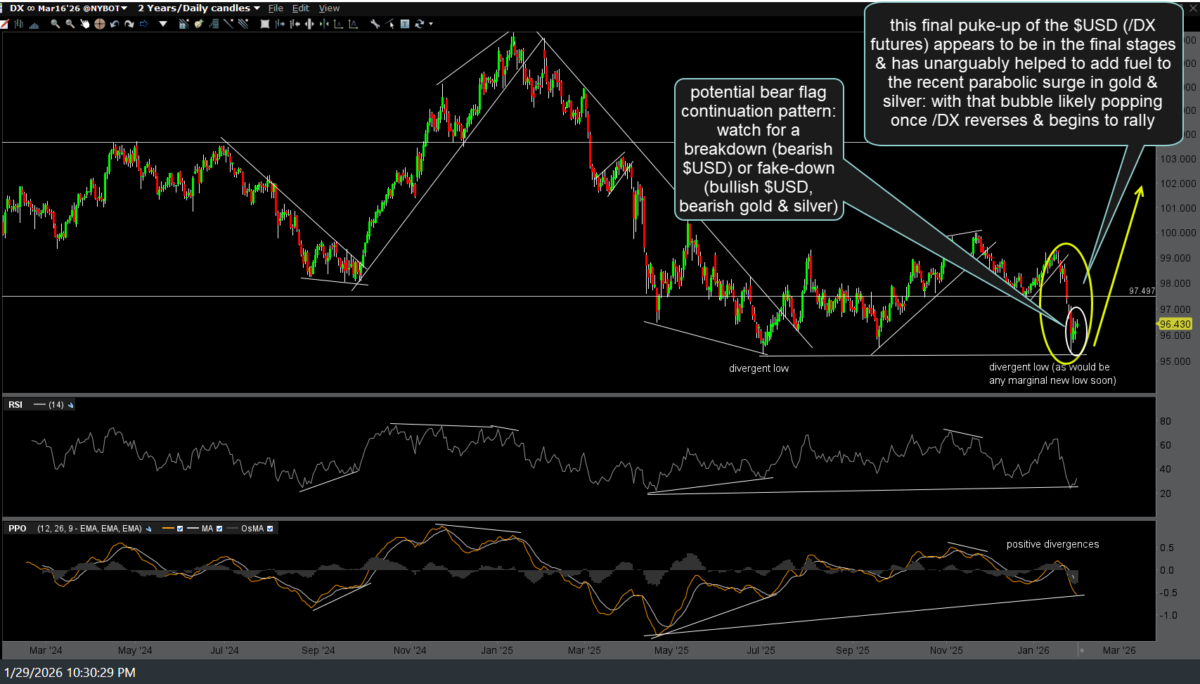

This final puke-up of the $US Dollar (/DX futures) appears to be in the final stages & has unarguably helped to add fuel to the recent parabolic surge in gold & silver: with that bubble likely popping once /DX reverses & begins to rally. Daily chart of /DX ($US Dollar futures, which tends to move inversely to gold & silver) below:

While the yellow arrow (i.e., the $USD is about to reverse & rally) is my preferred scenario, I would be remiss not to point out the potential bear flag continuation pattern that appears to be forming on /DX: Watch for a breakdown (bearish $USD) or fake-down (bullish $USD, bearish gold & silver). Either way, while I favor the former (a crash in gold & silver with a rally in the Dollar appears imminent), a little more puking of $USD & the commensurate final stage vertical ascent in the metals is certainly a potential scenario. As such, best to wait for the aforementioned levels to break before adding to the current short trade on silver.