GLD (gold ETF or /GC, SLV, /SI, GDX, etc..) short entry triggered on this 60-minute rising wedge breakdown. Previous (yesterday’s setup) & today’s updated 60-minute charts below.

For a more conservative entry with a higher probability of the breakdown sticking, one could either wait for a solid 60-minute close below the uptrend line on GLD or only take a starter (partial) position here, bring the short up to a full position on a solid 60-minute candlestick close below the wedge as well as a break below the uptrend line & intersecting 2000 price support level on this 60-minute chart of /GC (gold futures).

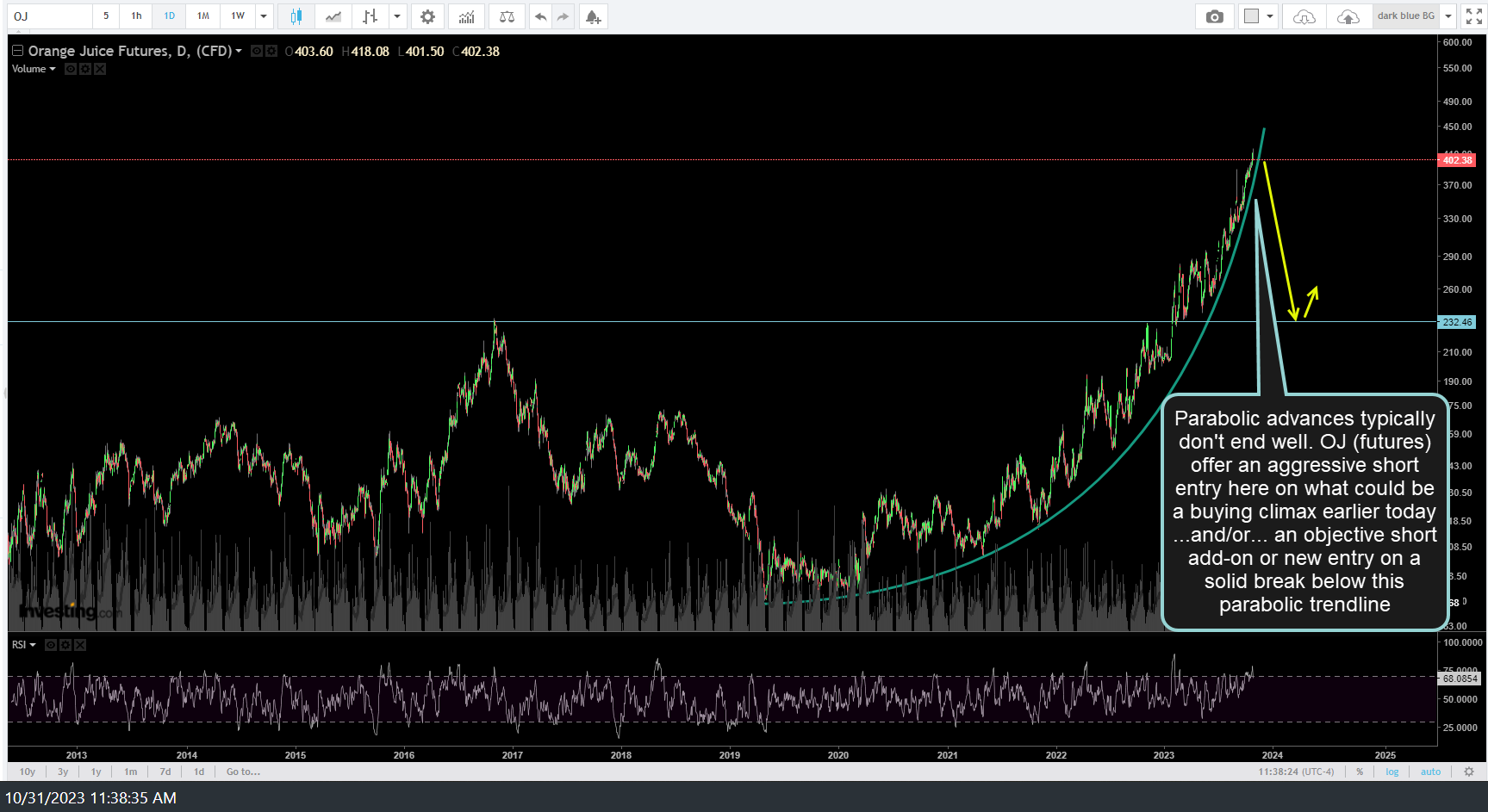

On an unrelated note, I figured I’d throw this one in here vs. a dedicated home page post as this is a somewhat obscure trade idea (futures only, no ETFs or ETNs tracking OJ prices that I am aware of):

/OJ (orange juice futures) offer an aggressive short entry here on what could be a buying climax earlier today …and/or… an objective short add-on or new entry on a solid break below this parabolic trendline (daily chart below).

@jmccallum mentioned /OJ in this comment thread about a month ago and I’ve been watching them since. No solid sell signals yet but I did notice what appeared to be potential buying climax with a sharp move up on high volume on the 5-minute chart out of the gates earlier today so I decided to take a starter short position which I will only add to on weakness (lower prices).

Here’s a recent article citing some of the causes for the surge in OJ futures for those interested.