I had planned to include an update with the 60-minute chart at the bottom of this post along with some comments on natural gas in today’s Charts I’m Watching post before my power went out but had to cut that post short & get it published before my battery backup died. I’ve since received a text from Florida Power & Light that they don’t expect to have power in my area restored for another few hours which prompted me to fire up one of my generators & reminded me of the rolling blackouts in CA that have been in the news lately.

Well before all the recent buzz about the rolling blackouts in CA by PG&E, as well as some other California utilities that figured the almost have to follow suit, lest they face the same liability, should their powerlines spark another wildfire like the Camp Fire started by PG&E’s lines, I posted taking long positions in two generator-related companies; BGG, an indirect play that makes small gas engines used in generators manufactured and/or sold by other companies and GNRC, a pure-play generator manufacturer.

BGG was stopped out shortly after entry (suggested stop was 8.89, hit shortly before the big gap down) as the company has been plagued with fundamental issues while GNRC has steadily advanced since then, gaining about 60% so far & while certainly getting a bit stretched (overbought) with potential negative divergences forming on the daily chart which increases the change of a correction in the foreseeable future, the fundamental case for the stock from just the rolling blackout in California along (which are now happening with the seasonal winds kicking up) not to mention the increase we seen in recent years from both the frequency & intensity of hurricanes making landfall in the US & Carribean, I would have to imagine the demand for generators will remain strong going forward.

Original mention & case for the generator stocks can be viewed here & the follow-up analysis & chart on GNRC here, where I has also mentioned that an additional benefit of that stock was the fact that it was not a component of the major large-cap indexes (DJIA, SPX, NDX) and a such, would not be weighted down if the broad market didn’t rise & so far, that has most certainly been the case with the broad market (S&P 500) basically flat (up ~2%) since then vs. a ~60% gain on GNRC. Pretty much, the same theme that I’ve been focusing on most of the year as the stock market refuses to go down yet it also hasn’t been able to go either, so far yet to gain anything more than 3% above the high back in Sept 2018 over a year ago.

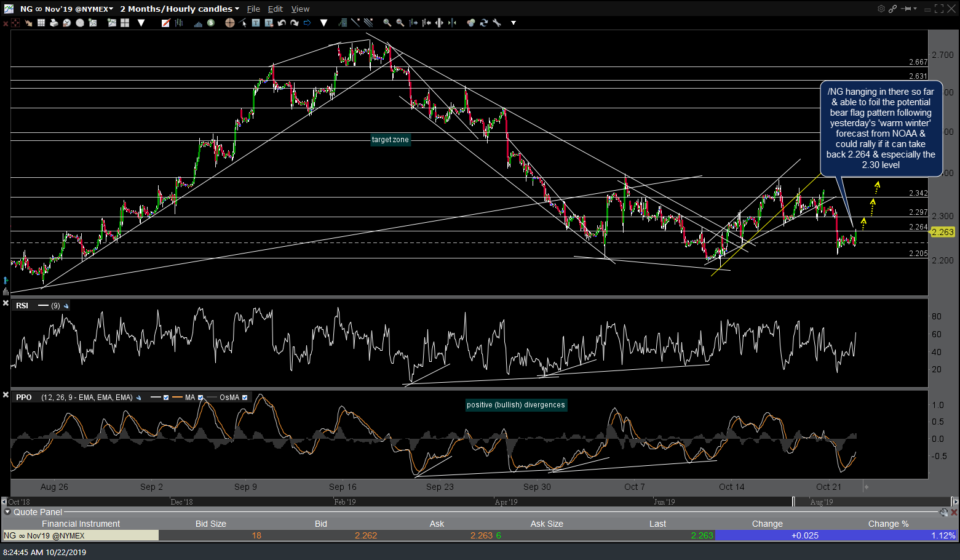

Now onto natural gas. /NG (nat gas futures) have been hanging in there so far & able to foil the potential bear flag pattern following yesterday’s ‘warm winter’ forecast from NOAA & could rally if it can take back 2.264 & especially the 2.30 level. Keep in mind that I took the screenshot of this 60-minute chart before the stock market opened today, shortly before I lost power. Since then, /NG took out that 2.264 resistance level it was testing at the time & is currently testing the big 2.30ish resistance level.