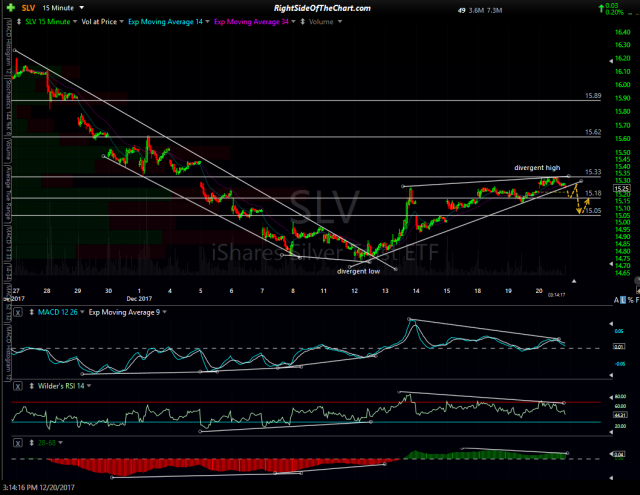

Both GLD (gold ETF) & SLV (silver ETF) appear poised for a mild correction following their recent bullish breakouts & rallies up to resistance. The 15-minute charts list a few near-by support levels which are likely to serve a end-points for any correction triggered by a break below this 15-minute bearish rising wedge patterns which are confirmed with negative divergences on the MACD & RSI. Should these divergences fail to play out for a pullback at this time, GLD & SLV will likely still have negative divergences in place on any marginal new high over the next day or so. Overhead resistance levels/target are also listed on the charts below, should the PM’s continue to rally from here.

- GLD 15-min Dec 20th

- SLV 15-min 2 Dec 20th