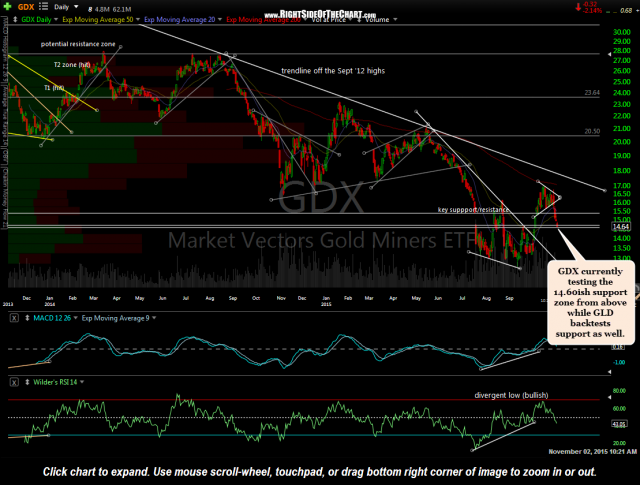

GDX (Gold Miners ETF) is currently testing the 14.60ish support zone from above while GLD backtests support as well. GLD (Gold ETF) is backtesting the recently broken secondary downtrend line while the MACD backtests the zero level. The MACD often defines the current trend; bullish when the MACD is trading above the zero line & bearish when below. Also note how the MACD zero line often acts as support when tested from above & resistance when tested from below.

- GDX daily Nov 2nd

- GLD daily Nov 2nd