After several attempts to regains the 25.67ish R level, GDX finally gave up, moving sharply lower today with the gold mining stocks currently backtesting this descending price channel from above. GLD also failed at the resistance zone that I had highlighted in last week’s video but is also trading at support which is the 1-month uptrend line generated off of the October 7th lows. Daily charts of GLD & GDX:

- GDX daily Nov 7th

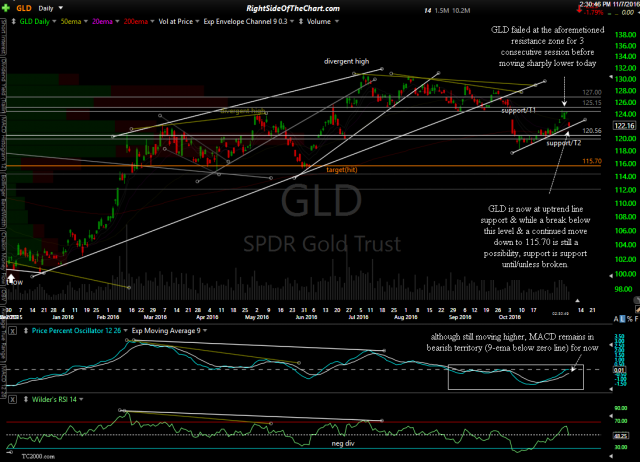

- GLD daily Nov 7th

Zooming down to the 60-minute time frames, after failing on the very brief & shallow attempt to break above this 60-minute symmetrical triangle pattern, GDX has now fallen to the bottom of the pattern (support) with a definitive break of the pattern likely to occur soon as prices are starting to approach the apex of the wedge. Along with GDX, GLD has now falling to uptrend line support on the 60-minute time frame & will likely either bounce here or break below that support level soon.

- GDX 60-minute Nov 7th

- GLD 60-minute Nov 7th

I have to say that my confidence on where gold & the previous metal miners go from here isn’t very high. While I slightly favor a continued move lower, possibly down to the 115.70 level in GLD, should these support levels give way with conviction, my confidence is not high enough to be long or short here and as such, I have closed out the NUGT short trade that I posted taking in the trading room & well as in the video just off the highs on Wednesday when both GLD & GDX were trading at those key resistance levels.