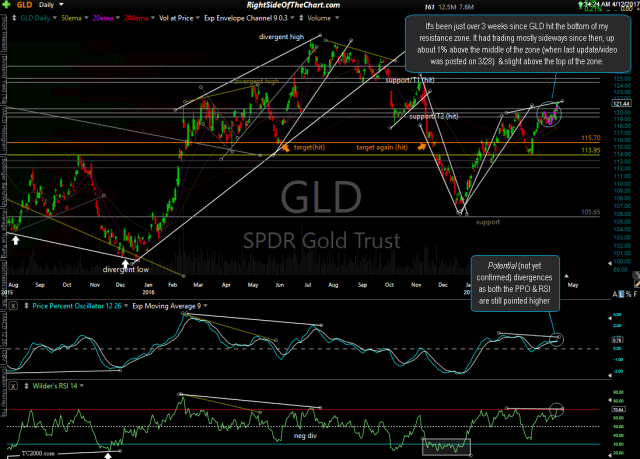

Member @dpatel asked for my thoughts on GDX in the trading room. Typically, when I go “quiet” on a major asset class, such as gold & the miners, I don’t have much of an opinion or good read on the charts. I’ve also stated that in recent weeks with the last update on GLD & the miners back on March 28th in the GLD, GDX & US Dollar Analysis video. In that video, I highlighted the most likely scenario for GLD which would be a reaction in the form of a minor pullback/consolidation to work off the near-term overbought conditions & build up the energy to make a break above the top of the resistance zone & a potential move up towards the next resistance zone that comes in around 124.50- 125.15. A screenshot from that video is shown below followed by the updated chart of GLD showing that is indeed what has occurred in GLD since then, with GLD making a modest pullback & consolidation & just recently moving higher to take out the top of the resistance zone.

- GLD daily screenshot March 28th

- GLD daily April 12th

Normally I might view this recent break above the top of the resistance zone as the next buy signal in GLD for a potential swing trade up to that next resistance/target zone. However, while that may very well be the case, the one thing giving me pause at this time is the potential negative divergence forming on both the daily & 60-minute time frames of GLD. I use the word potential since both the PPO, MACD & RSI are all still pointed higher & as such, should GLD continue to advance much more before pulling back, those divergences would likely be negated, or burned through.

- GLD 60-min April 12th

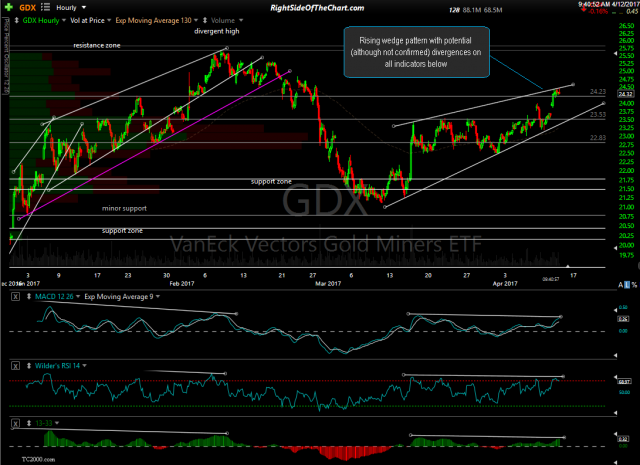

- GDX 60-min April 12th

I have no desire to short either GLD or GDX at this time, instead still preferring to stand aside in focus on other opportunities in the market. Another reason(s) for standing aside from the gold or GDX trade right now are these potential bearish rising wedge patterns on the 60-minute charts of both GLD & GDX. Again, potential but still unconfirmed divergences on the indicators below those wedges & while those divergences may very well be negated, especially if the broad markets start to experience an impulsive selloff, I try to avoid trading any security in which I can’t make a clearly bullish or bearish case. If I see any compelling developments in the technicals on GLD and/or GDX, I will do my best to share them asap.