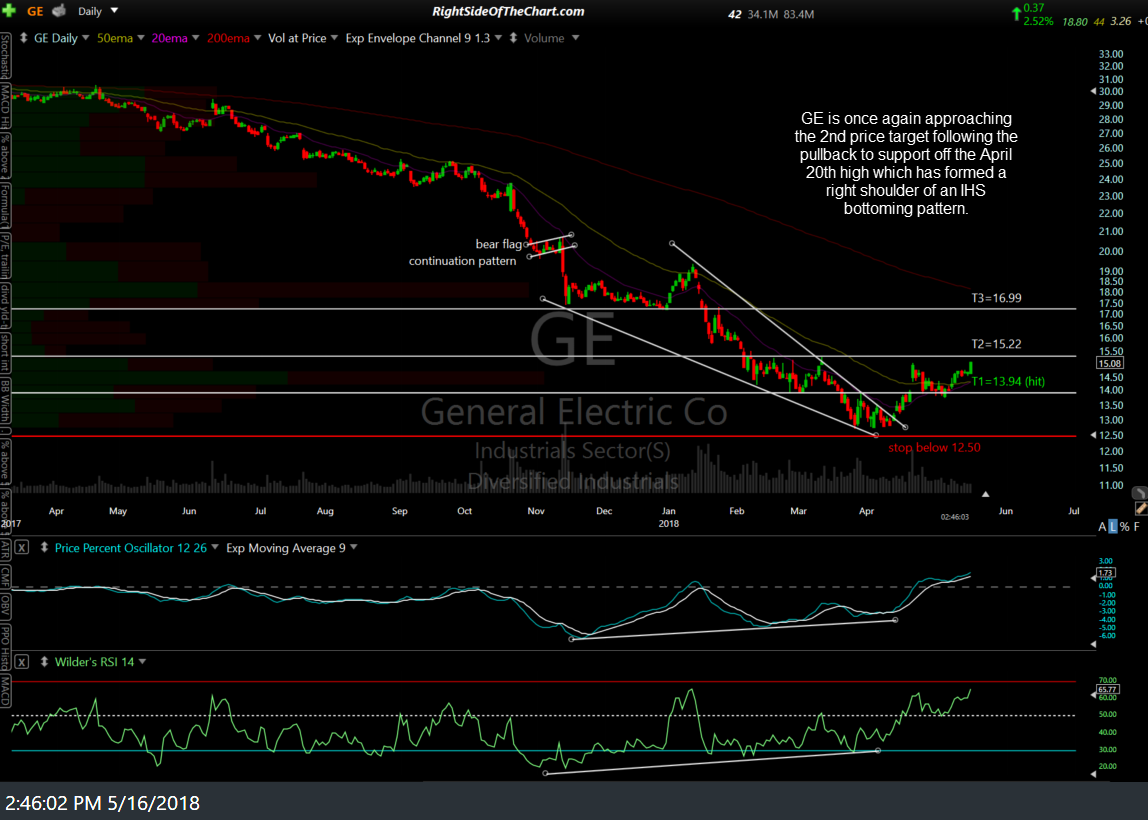

The GE active Swing Trade + Growth & Income Trade idea is closing in on the second price target. GE also fell just shy of T2 on April 20th, pulling back to the T1 (support) with the stock forming what appears to be the right shoulder of a potential Inverse Head & Shoulders bottoming pattern with the neckline of that pattern roughly inline with T2.

- GE daily IHS May 16th

- GE daily May 16th

The stock might have a reaction (minor pullback and/or brief period of consolidation) here soon around the neckline and 15.31 resistance level which T2 is strategically set just below. However, an impulsive breakout above both the neckline & the 15.31 resistance level would have longer-term bullish implications & increase the chances that the final target, T3, will be hit in the coming weeks to months.