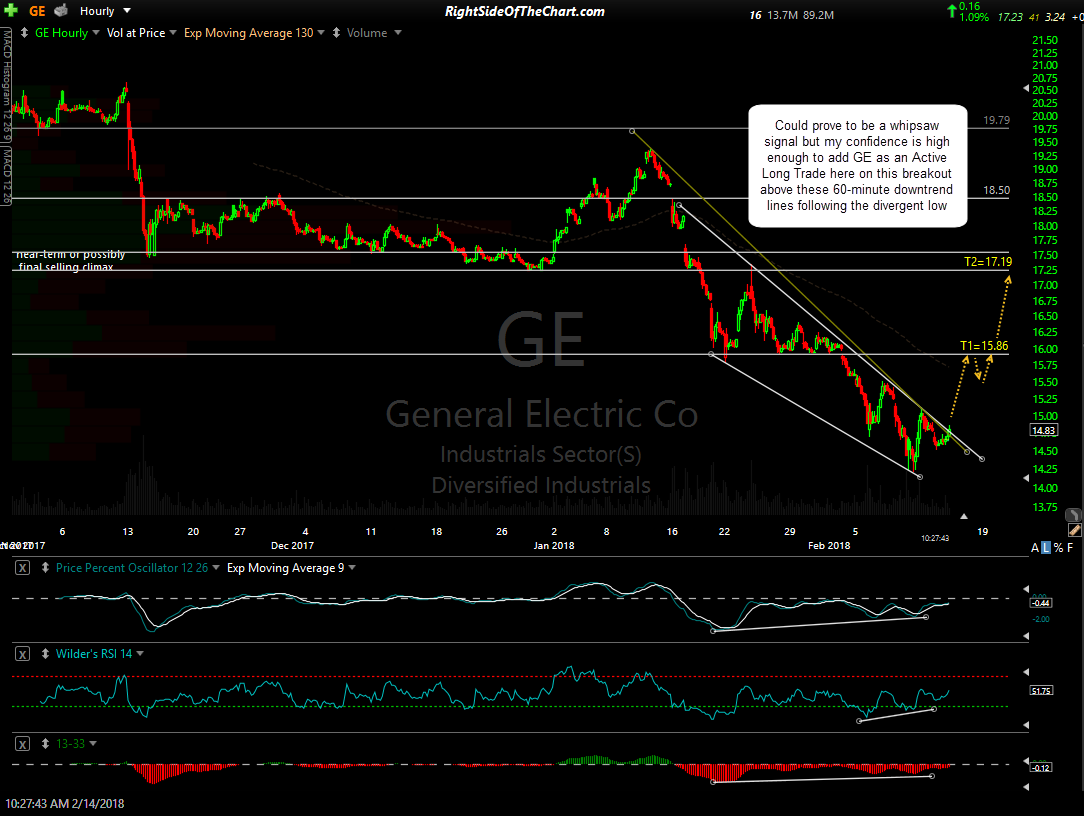

This could prove to be a whipsaw signal but my confidence is high enough to add GE as an Active Long Trade here on this breakout above these 60-minute downtrend lines following the divergent low. Price targets are T1 at 15.86 & T2 at 17.19 with a suggested stop on any move below 14.09. The suggested beta-adjusted position size is 1.0 (i.e.- a typical position size).

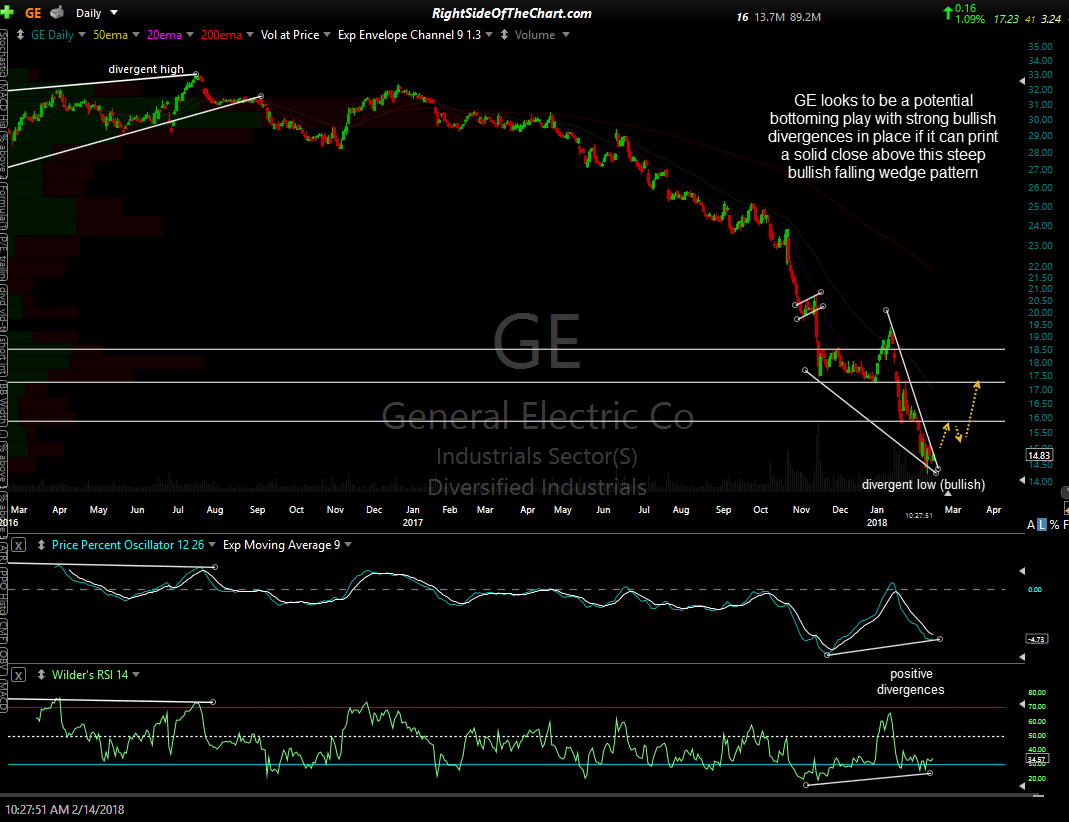

GE also looks to be a potential bottoming play with strong bullish divergences in place if it can print a solid close above this steep bullish falling wedge pattern. One could also use a daily close above this downtrend line as an alternative entry with a higher probability of the trade playing out albeit at the risk of a less favorable entry price, should GE continue to rally into the close today as I suspect it will. Daily chart below: