So far today, both GLD (Gold ETF) & GDX (Gold Miners ETF) gapped down & continued lower but have since recouped all of their post-opening losses & then some while the equity markets gapped up, rallied from there but topped out shortly after & have since been moving lower… essentially a near inverse mirror between the price action in the PMs & equities so far today. Should the current trends (stocks moving lower while gold & GDX rally) continue into the close today, that would indicate distribution in equities (sellers stepping in to sell the rallies) in equities & accumulation (buyers stepping in to buy the dips) in precious metals.

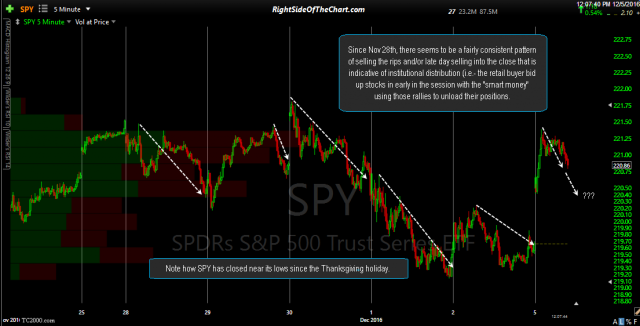

- SPY 5-minute Dec 5th

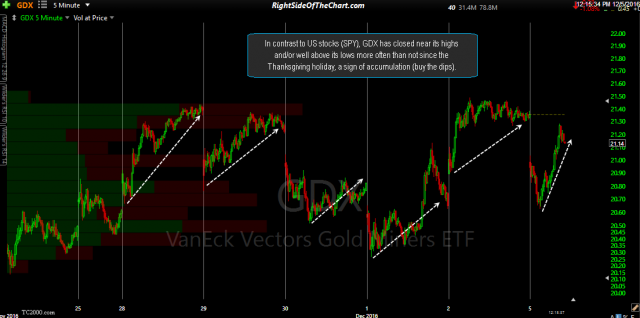

- GDX 5-minute Dec 5th

While one day does not make a trend, this seems to be the recent pattern in both, with SPY closing near its lows or seeing nice intraday gains faded into the close on on several occasions over the last week or so & GDX closing well off its lows, while both GDX & SPY have essentially traded sideways over the last week or so .

Since Nov 28th, there appears to be a fairly consistent pattern of selling the rips and/or late day selling into the close that is indicative of institutional distribution (i.e.- the retail buyers bid up stocks in early in the session with the “smart money” using those rallies to unload their positions). Note how SPY has closed near its lows since the Thanksgiving holiday while in contrast to US stocks (SPY), GDX has closed near its highs and/or well above its lows more often than not since the Thanksgiving holiday, a sign of accumulation (buy the dips).