The price targets for the GDX (gold miners ETF) long swing trade, which was posted as a new trade in this post published earlier today along with the update on the previous GDX trade which was stopped out last Friday, are listed below. That post also followed this analysis on gold & the US Dollar which is almost certain to have an impact on where the miners trade in the coming weeks to months.

The price targets for this latest swing trade on GDX are T1 at 21.77, T2 at 21.98, T3 at 22.61 & the final target, T4, at 22.92. The maximum suggested stop (if targeting T4) is a daily close below 20.55. The suggested beta-adjusted position size for this trade is 0.70.

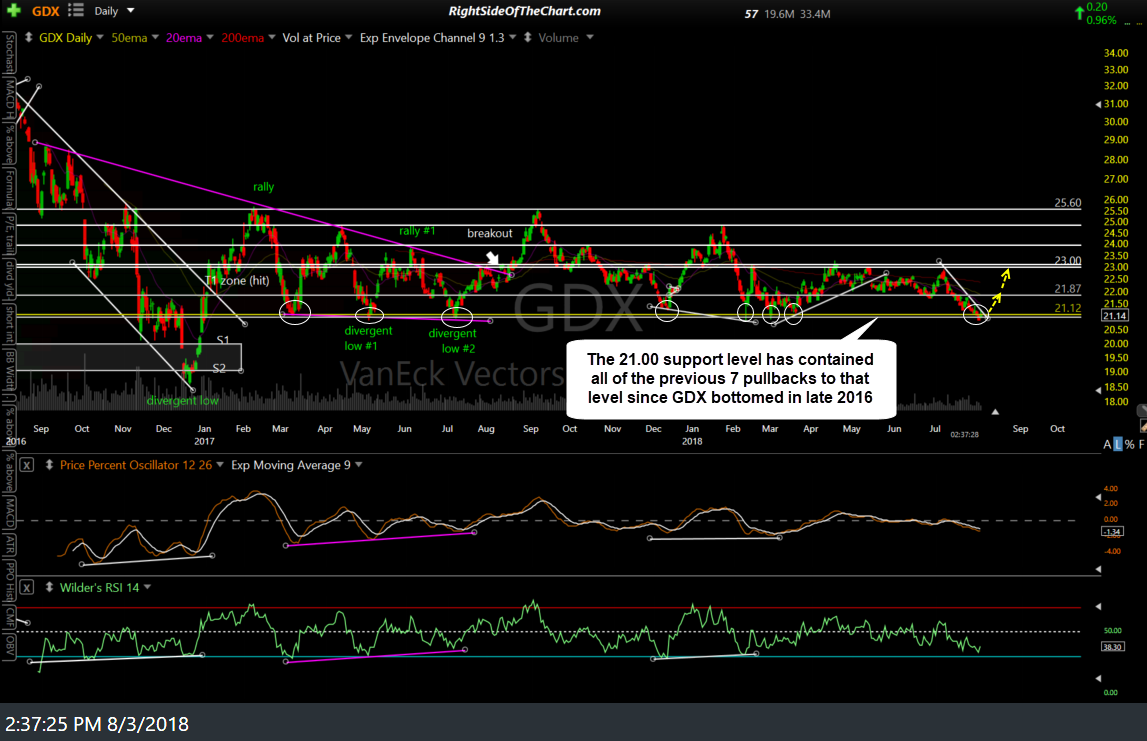

The white circles on the daily chart above highlight the fact that this is the 8th time that GDX has fallen to the 21.00 support level since the gold mining sector bottomed back in late 2016. Based on my expectation for a little more downside in the Euro & upside in the US dollar (see link above), with a false breakdown scenario, I am very open to a similar brief wash-out move below the 21.00 area in GDX. Should that occur, followed by a recovery back above the 21.00 level in the coming days to weeks, that would be quite bullish for the mining stocks as it would serve to suck in some more shorts (who could be squeezed out on a reversal) as well as shake out some more weak-handed longs.

While I might lean towards the false breakdown scenario, with GDX already hitting support today coupled with potentially explosive nature of the mining stocks, I’d rather be a little early than a little late on this trade. Of course, as with any trade, this one may or may not pan out & as such, best to use a stop, or stops, which are in line with your own unique R/R parameters & based off your preferred price target(s), assuming that this aggressive “catch-a-falling-knife” trade on a historically volatile sector even meshes with your trading style & objectives to begin with.