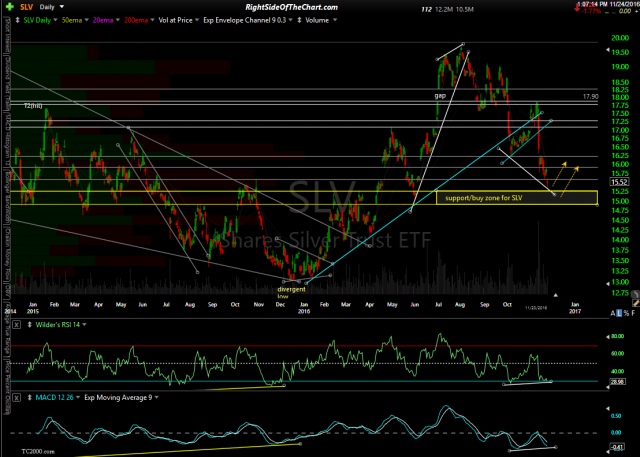

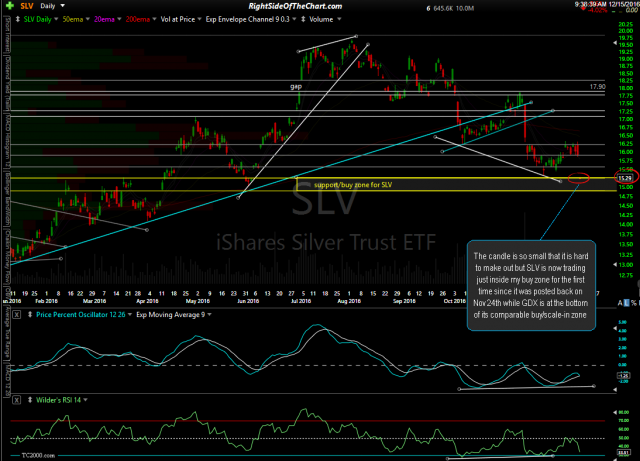

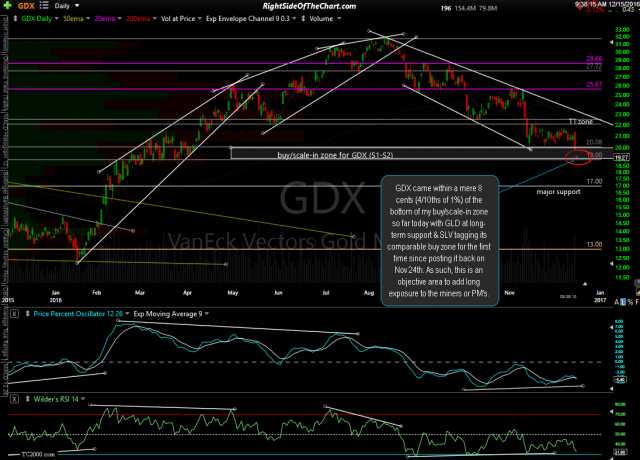

With the precious metals & miners gapping down sharply today, SLV (Silver ETF) is now in the buy zone for the first time since it was posted back on Nov 24th while GDX (Gold Miners ETF) is at the bottom of its comparable buy/scale in zone for the first time since then as well. (Nov 24th & updated charts below).

- SLV daily Nov 2th

- SLV daily Dec 15th

- GDX daily Nov 24th

- GDX daily Dec 15th

As an unofficial trade & particularly due to the fact that when one is scaling in, they will have a unique cost basis depending on their average entry price, suggested stops are not provided but I can say that it is probably best to wait for some half-decent technical evidence of a reversal before taking a full position in GDX, GLD and/or SLV.