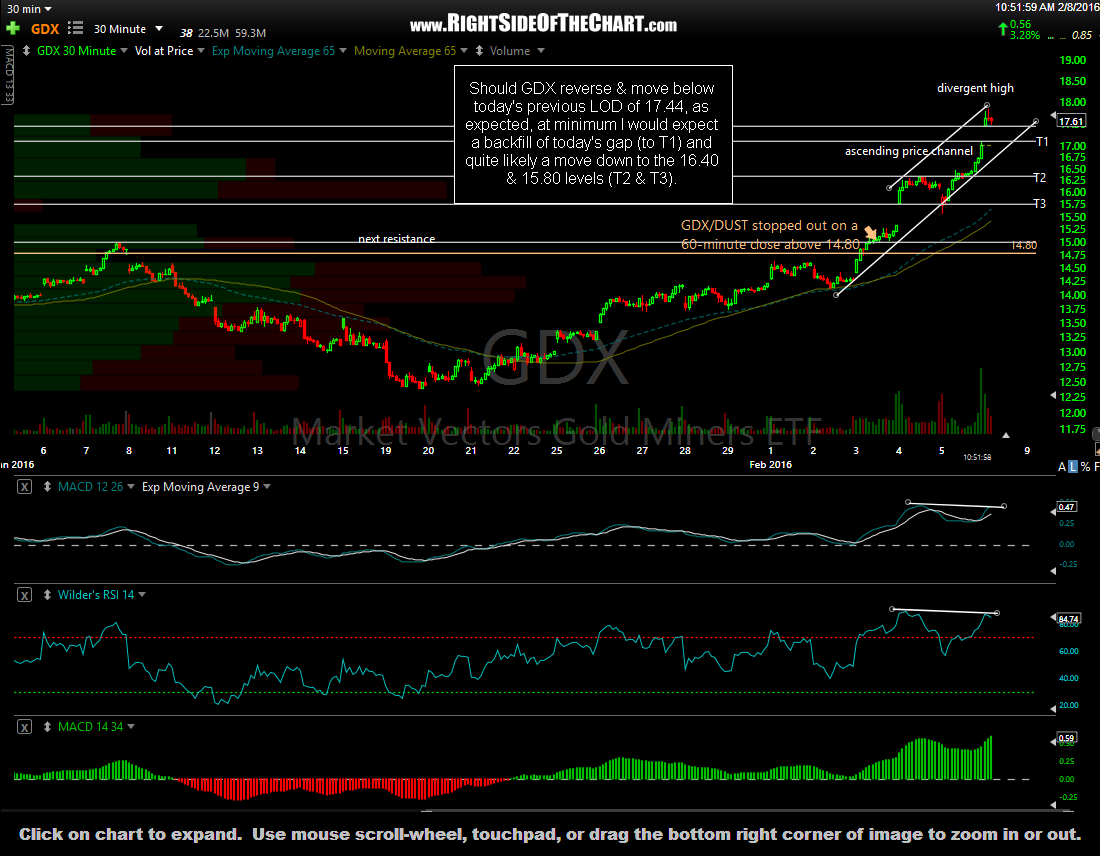

Should GDX reverse & move below today’s previous LOD of 17.44, as expected, at minimum I would expect a backfill of today’s gap (to T1) and quite likely a move down to the 16.40 & 15.80 levels (T2 & T3).

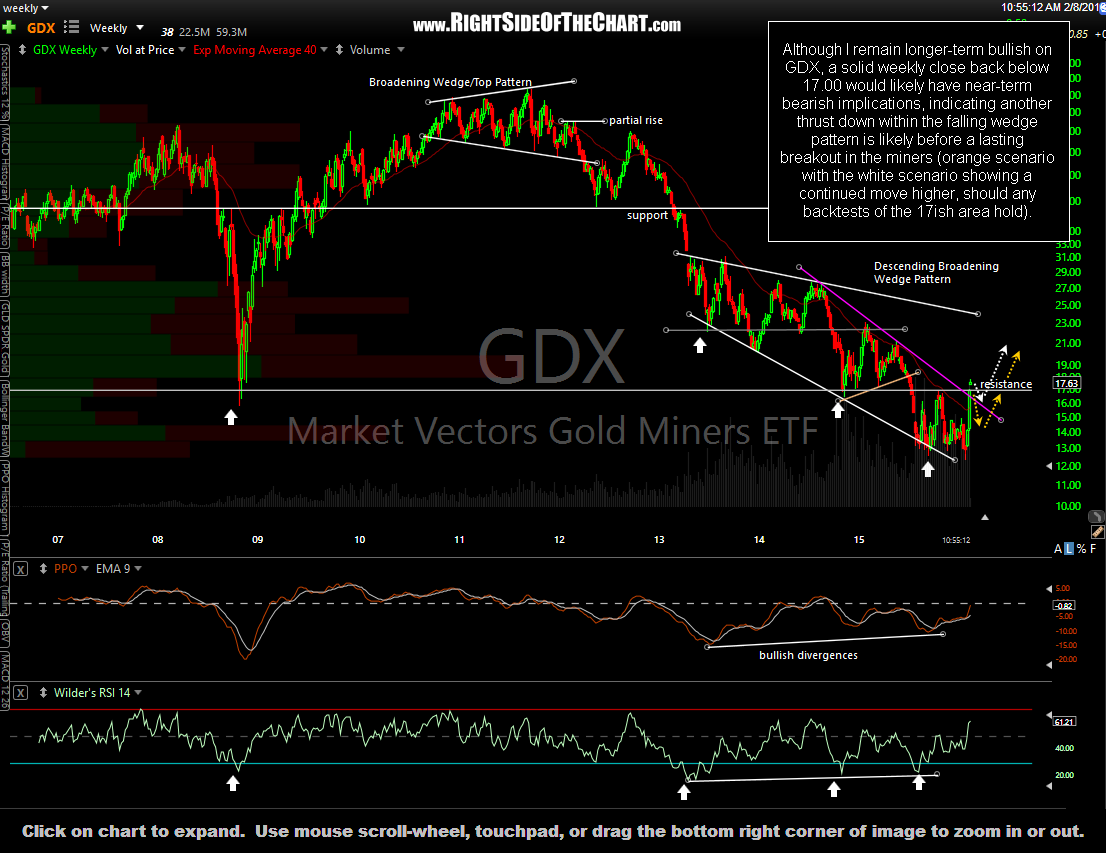

While I remain longer-term bullish on GDX, a solid weekly close back below 17.00 would likely have near-term bearish implications, indicating another thrust down within the falling wedge pattern is likely before a lasting breakout in the miners. This is only a potential scenario that I’m open to at this time but until/unless we get a solid weekly close below 17.00, the near-term trend remains bullish in the mining stocks. The bullish (white) scenario would have this breakout sticking & GDX continuing higher, quite likely after a backtest of the top of the wedge with the orange scenario, the more bearish of the two, showing a failed breakout of the 17ish long-term resistance level, followed by a thrust back down inside the wedge pattern before a lasting breakout in the miners.