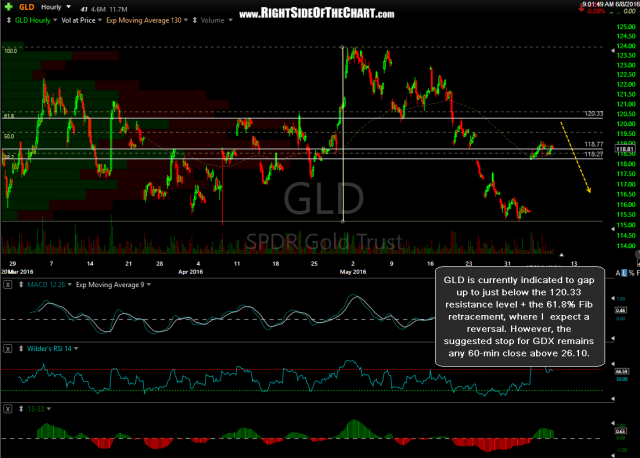

After hitting the first two targets & reversing shy of the final target, GDX is current poised to gap just below the suggested stop of a 60-min close above 26.10. With resistance overhead in both GDX & GLD, this one is going to be close but I do not plan to modify the stops. GLD is currently indicated to gap up to just below the 120.33 resistance level + the 61.8% Fib retracement, where I expect a reversal. Again, the suggested stop for GDX remains any 60-minute candlestick close above 26.10.

- GDX 60 minute June 7th close

- GLD 60-minute June 7th close

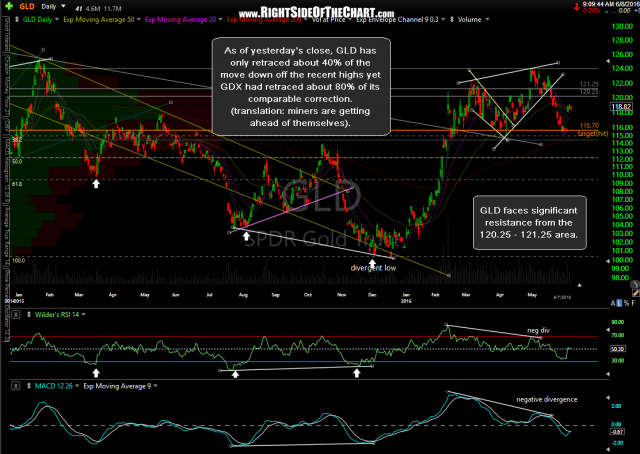

As of yesterday’s close, GLD has only retraced about 40% of the move down off the recent highs yet GDX had retraced about 80% of its comparable correction. Does GDX know something the gold market doesn’t know or are the miners getting ahead of themselves?

- GDX daily June 7th close

- GLD daily June 7th close