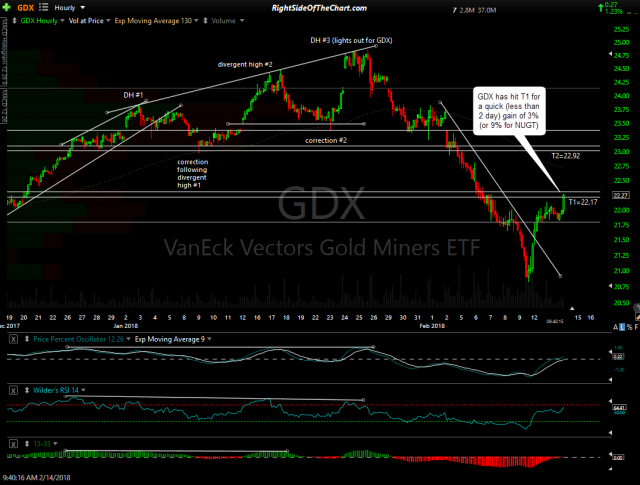

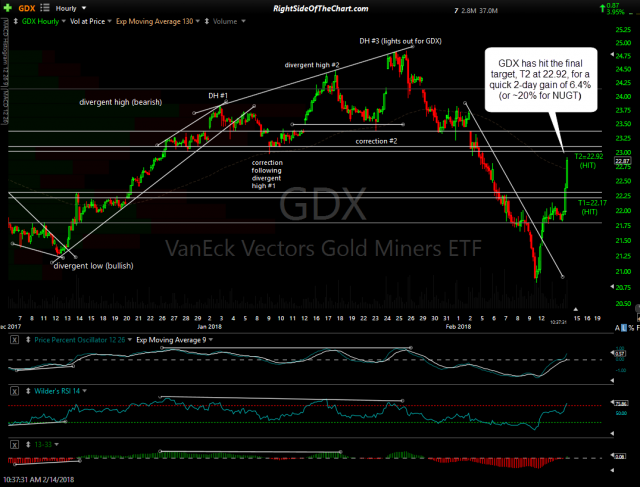

The GDX (Gold Miners ETF) swing trade has hit the final target, T2 at 22.92, for a quick 2-day gain of 6.4% (or ~20% for NUGT). Consider booking profits or raising stops if holding out for additional gains as the potential for a more powerful rally in the gold mining sector was recently made in the February 11th GDX, Gold & US Dollar Technical Analysis video. As this was the final target for this swing trade, GDX will now be moved to the Completed Trades archives. Previous & updated 60-minute charts:

- GDX 60-min Feb 12th

- GDX 60-min Feb 14th

- GDX 60-min 2 Feb 14th

click on first chart to expand, then click on the right of each expanded chart to advance to the next chart