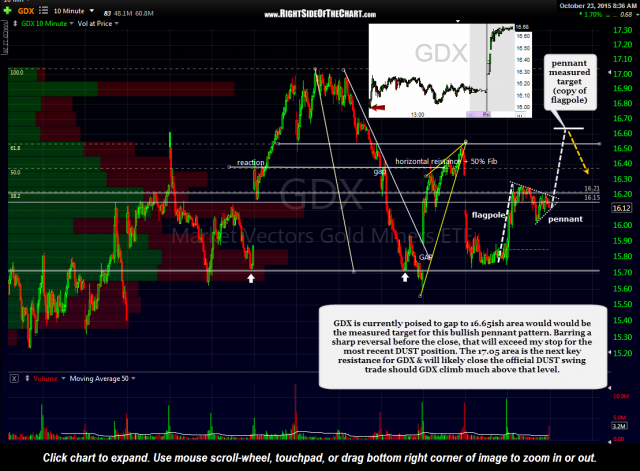

GDX is currently poised to gap to 16.65ish area would would be the measured target for this bullish pennant pattern. Barring a sharp reversal before the close, that will exceed my stop for the most recent DUST micro-managing (unofficial) trade taken yesterday. The 17.05 area is the next key resistance for GDX & will likely close the official DUST swing trade should GDX climb much above that level.

GDX DUST Update

Share this! (member restricted content requires registration)

7 Comments