GBTC (Bitcoin Trust) will be added as an Active Long Swing Trade around current levels as it hit the downside target on my daily chart (support) with potential bullish divergences forming on this 60m chart.

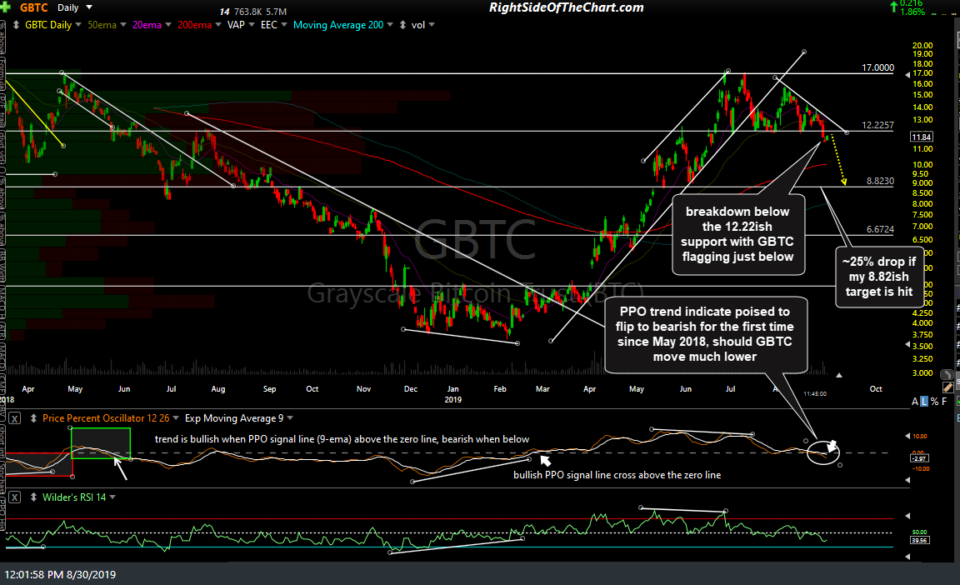

GBTC has just hit my 8.82 price target from the August 30th post “Is Bitcoin About To Drop 25%?” in which the case was made for, well, a 25% drop in Bitcoin. Actually, I’ve been calling for a drop to the 8.82 level since this ‘Bitcoin “Return To Normal” Rally Likely Over’ post all the way back on July 18th except back in July (as the first chart below shows), I was calling for one more leg up before the drop down to 8.82, which is pretty much exactly what happened since then.

- GBTC daily July 18th

- GBTC daily Aug 30th

- GBTC daily Oct 16th

With GBTC now trading at that key support level while oversold on the daily timeframe along with the potential (but not yet confirmed) positive divergence on the 60-minute time frame, GBTC offers an objective yet fairly aggressive entry as Bitcoin is solidly entrenched in a downtrend/bear market with absolutely zero buy signals at this time. As such, one should pass if this aggressive “trying-to-catch-a-falling-knife” type trade does not mesh with their trading style and/or risk tolerance.

The price targets are T1 at 10.46 & T2 at the first of the yellow downtrend line or the 11.83 level. The suggested stop is any move below 7.75 if targeting T2 (higher, if planning to book partial or full profits at T1). Due to the aggressive nature of this counter-trend trade coupled with the very high-volatility & above-average gain/loss potential for this trade, the suggested beta-adjusted position size is 0.65.