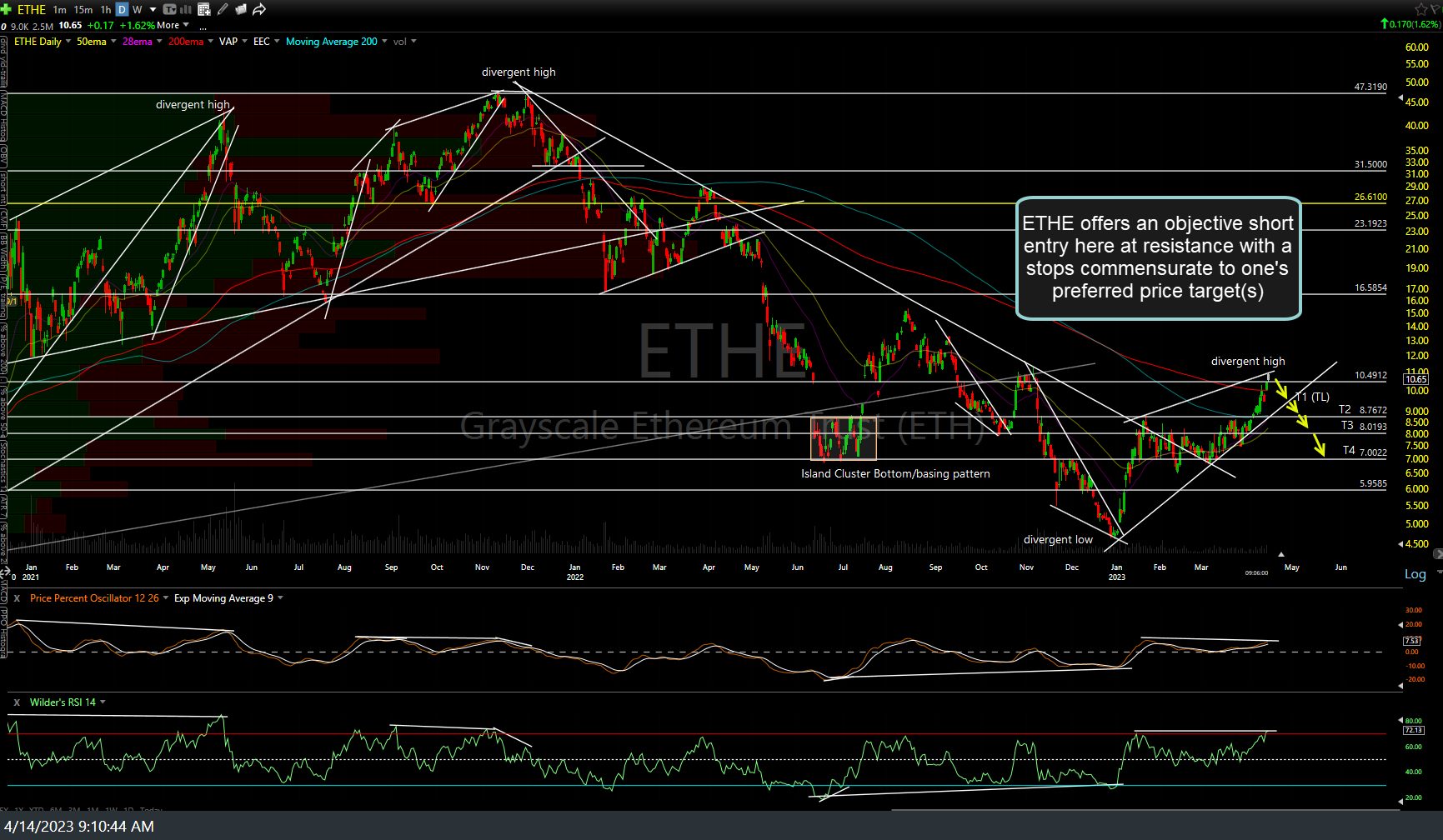

The ETHE (Ethereum Trust) short trade has triggered the next sell signal on a break below T3 (third price target/support) after more than month of tight sideways consolidation on that level (with T2, now resistance, capping the upside of that range). Original (April 14th) & updated daily charts below.

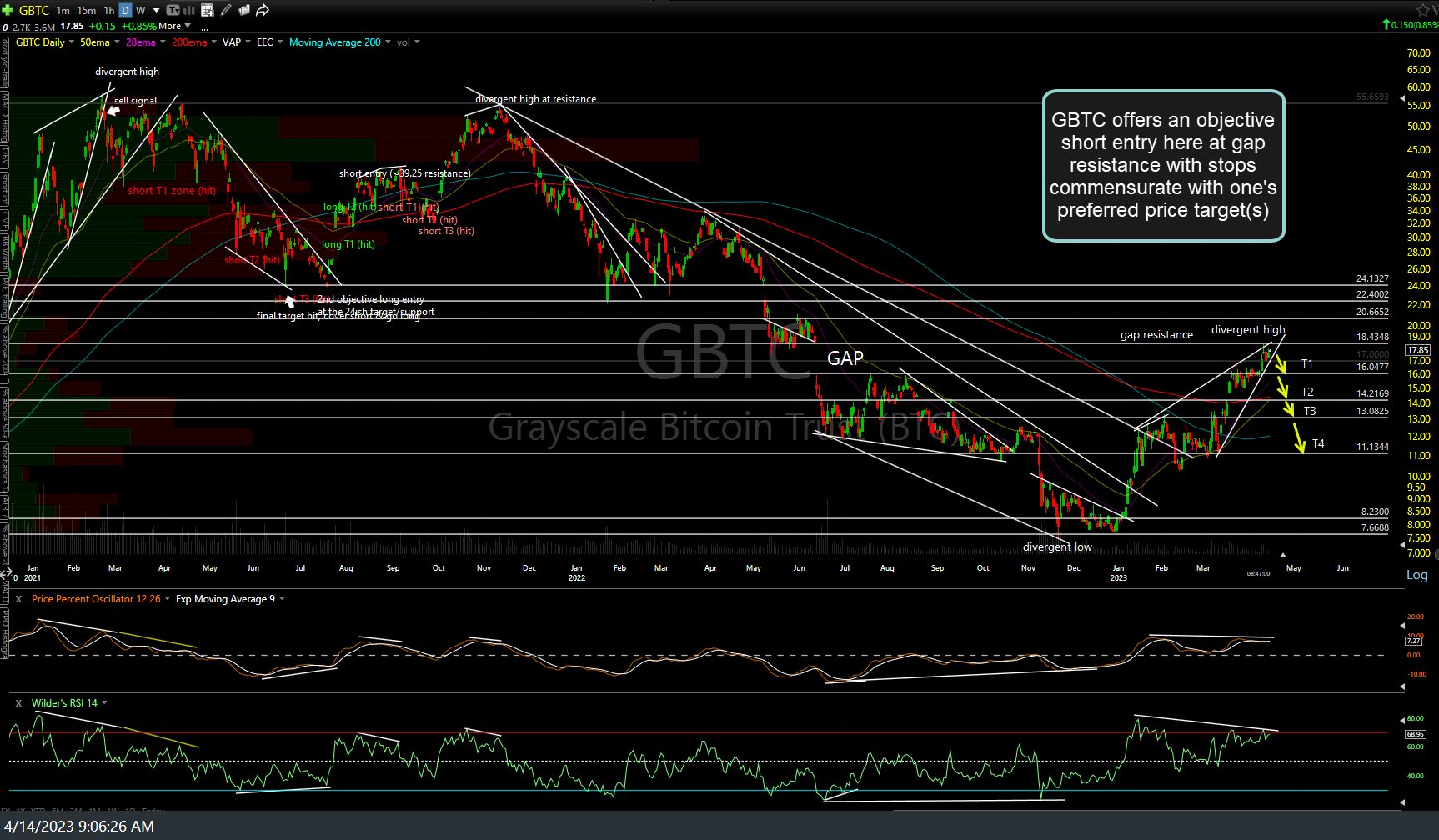

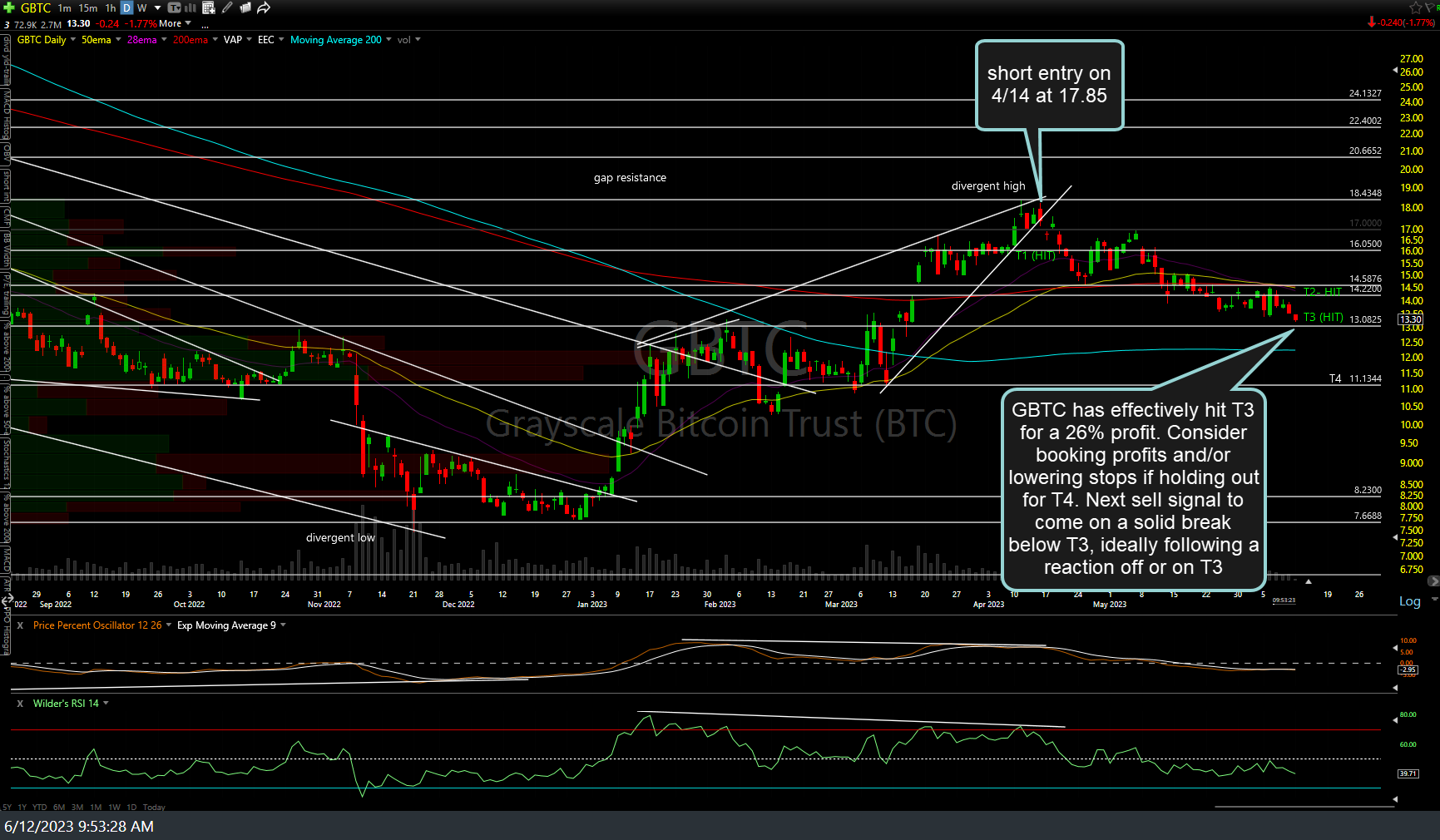

This puts ETHE at about a 27% gain so far as we basically nailed the highs on the short entry back on April 14th. While the break of the T3 (8.02) support level would normally provide an objective add-on, the GBTC (Bitcoin Trust) swing short, also entered right off it’s highs on April 14th, has just effectively hit T3* for a 27% profit as well. That increases the odds of a reaction for Bitcoin here or just below & as Bitcoin & Ethereum are highly correlated, a bounce or consolidation in Bitcoin would most likely result in the same for Ethereum.

Depending on your trading plan, consider booking partial or full profits and/or lowering stops to protect gains if holding out for any of the additional targets on both ETHE & GBTC. Original (April 14th) and updated daily charts below.

*Price targets shown for short trades are the actually support levels where a reaction is likely upon the initial tag. It is always best to cover a short slightly above the support level one is targeting in case the buyer’s step in early. As of now, GBTC has come within 1% of T3 (13.0825) today, which is effectively a hit of that target).