Just a few quick points to mention before the US markets open for trading today:

- OpEx- With today being the the third Friday in the month, most stock & index options are set to expire at the end of the day. Options expiration days are typically marked by choppy intraday price action which often serves to run stops & trigger whipsaw breakouts on both longs & shorts alike. Although not a set rule, I will often allow a little extra room my stop-loss orders for any swing positions that are close to being hit while being more selective with opening new positions, should a stock breakout of a pattern that I am following. Again, just general rules with exceptions being made on a case-by case-basis. On the flip-side, I will always take advantage of volatility to exit a position if my price target is hit, hence I will leave my sell limit (or buy-to-cover limit) orders in place.

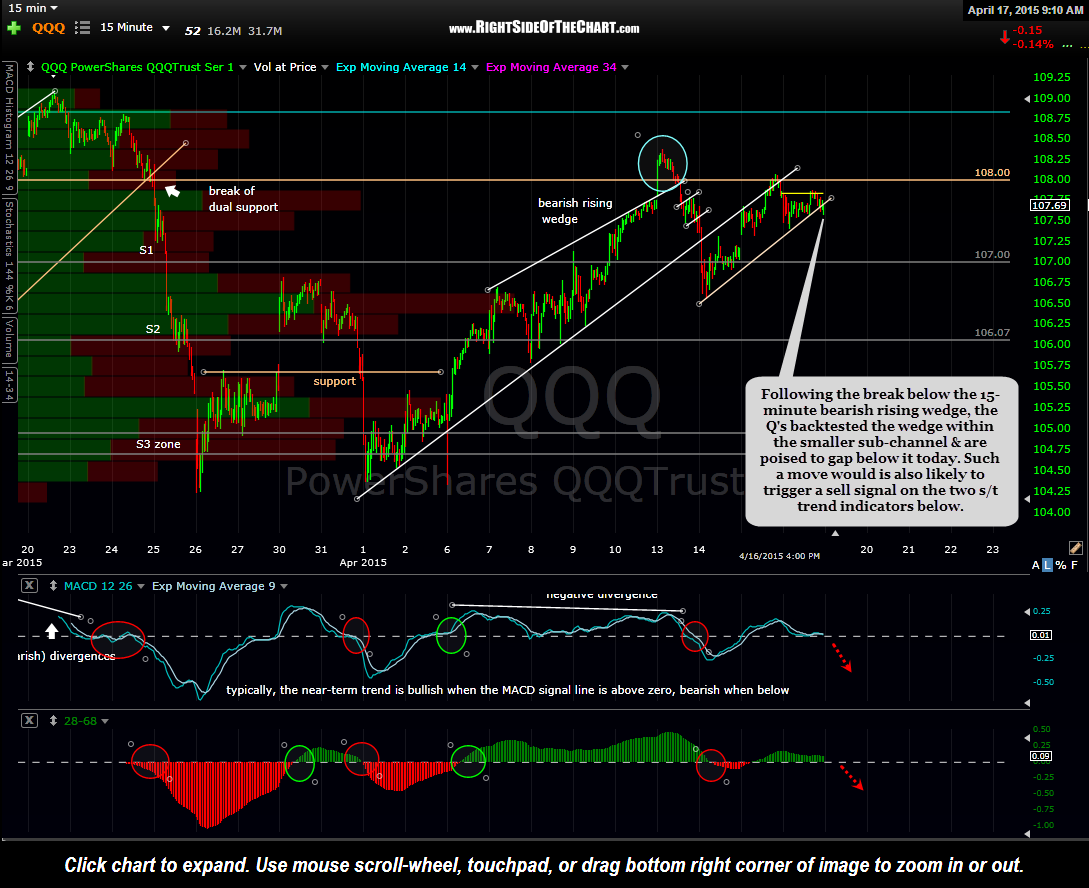

- US equities- With 30 minutes to go before the market opens as I type, the US equity markets are current poised to gap lower. As recently mentioned, I made the decision to sit tight on my broad market shorts, neither adding or subtracting any exposure due to the very erratic price action over the last week and will continue to sit tight heading into the weekend unless the markets looked poised to print a strong negative close today, in which case I may add some short exposure before the closing bell.

- Despite the recent choppy price action and short-term whipsaw signals, I remain intermediate & possibly longer-term bearish on US equities. In fact, as bold a claim as it sounds, I reiterate my price target of 100.09 on the QQQ in which I had stated no less than 5 times over the last several weeks that I expect that target to be hit on or around April 23rd, which is next Thursday. Again, a very bold call as that would result in about a 7% plunge over the next 5 trading sessions. Unfortunately, the near-term charts just aren’t clear enough for me to bet it too hard at this time although it is worth mentioning that the QQQ is likely to trigger another series of short-term sell signals on the 15-minute time frame, should today’s potential gap lower stick.

- Crude oil & energy stocks- As stated yesterday, I believe that the odds are quite elevated for a pullback in crude at this time, possibly on one last thrust to a marginal new high. However, I remain longer-term bullish on crude oil & the energy sector. Additional updates to follow soon.

- Gold, silver & the mining sector: I continue to expect some choppy action until a clear resolution of the symmetrical triangle pattern that has been highlighted on the 60-minute time frame. I still favor an upside resolution of the pattern but plan to keep things light in the precious metal stocks for now.

Best of luck on your trades. -RP