One of the reasons that I went ahead and shorted the KRE (Regional Banking Sector ETF) well ahead of the potential Head & Shoulders Pattern breakdown & in spite of a relentless uptrend in the broad market has as much to do with the technical posture of many of the individual regional banks within the sector. Since posting the official short entry on KRE shortly before the closing bell yesterday, I began mocking up charts & setting price alerts on some of the most promising short candidates within the sector.

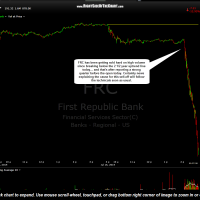

FRC (First Republic Bank) was one of those top picks but like many of the short candidates in the sector, prices were not trading close enough above the trigger (a break below the 2 1/2 year uptrend line) earlier today to warrant posting the setup, as I try to post Trade Setups as close as possible to when I believe they are ready to trigger an entry. The ironic part is that the only headline for the stock that I can find so far today was First Republic Reports Strong Quarterly Earnings, following the release of their quarterly earning report this morning. As the 1-minute chart below shows, the stock opened almost flat, traded somewhat lower & then suddenly plummeted around 2:05 pm ET. As the 2-day period chart below shows, that sharp plunge took the stock below my uptrend line/short entry level very quickly (with my price alert shown at the bottom left of the chart) but the stock was falling too fast to get the chart & accompanying trade comments ready in time to be posted while an entry was still objective. In fact, the stock hit what would have been my first target level less than 30 minutes later.

- FRC 1 minute

- FRC 2-day July 16th

As I was not able to post this trade idea before or at the time of an objective entry, FRC will not be added as an Active Trade at this time. I am simply pointing out today’s price action on FRC as there are several other regional banks hovering in close proximity to similar key uptrend lines or other important support levels or price patterns, as FRC was earlier today. Despite the relentless uptrend in the equity markets lately, complacency and bullishness has reached dangerous extremes where the proper catalyst, such as a technical breakdown, earnings miss, or other bad news can trigger very sharp & fast selling.

New short trade ideas have been far & few between lately, mainly because the market was in a clear uptrend & I just wasn’t finding many trades offering attractive risk/reward ratios. However, I do have a short-list of attractive candidates, including some additional names in the regional banking center which I will post shortly. As far as FRC, I’d like to wait to see what the catalyst was for today’s sudden plunge before considering adding it as an official short trade idea.