The point of this post is two-fold; First, to discuss the pros & cons of employing a flexible vs. rigid trading plan and secondly, to make a quick update on UCO/crude oil.

Some traders practice the use of rigid trading plans, whereby they identify exactly where they will book profits or take a loss (stop out) before they enter a position. While a rigid trading style certainly has its merits, my preference has always been to use a more flexible trading plan with many of my trades, often adjusting or modifying my profit target(s) and stop level(s) after establishing a position. After entering a trade, I continually monitor the charts of both the broad market, the sector of the position (individual stock or ETF) as well as technicals on the position itself. If the trade goes as expected without a material change in the technicals, my original trading plan (sell targets & stops) will remain in place. If something convinces me to extend my profit target or stop loss levels, or even to book profits early, then I typically don’t have a problem doing so.

An example of that would be the CDE (Couer Mining Inc) trade in which I decided to book full profits early yesterday for the reasons mentioned in that post (which can be viewed here). Essentially, although the trade was playing out as expected, the move higher since the original entry at the bottom of the right shoulder was virtually one-sided, without any significant pullbacks or consolidations along the way. In other words, CDE went up too much, too fast. This gave us the extreme overbought conditions highlighted yesterday while at the same time, CDE was about to run into a significant downtrend line that I had not noticed on the charts until shortly before I made that post.

Of course there were a few other reasons mentioned such as gold & silver also approaching resistance and shortly following that post yesterday, CDE went to to tag that downtrend line to essentially the penny before pulling a 180 and falling about 18% since then. I am still longer-term bullish on CDE as well as gold & silver as well as the mining sector in general and will be looking to reposition into most of the other miners that I booked profits on yesterday, including some other names that I am watching as well.

That brings me to crude oil, more specifically the USO trade. Yesterday before the open I had posted my intentions of holding off on my plan to stop out on 1/2 of my position if UCO traded below 7.50. I stated that I would give UCO a half-hour after the open to regain that level, which it almost managed to do but then it drifted between the 7.30-7.84 level for the rest of the day. Based on the fact that crude was holding up despite both weakness in the broad market & strength in the dollar, plus, the fact that the intraday (5-60 minute) charts continued to look to be setting up for an imminent reversal by my interpretation, I decided to hold onto my position, even sending this reply earlier today to a follower of the site inquiring if I was still holding UCO: Yes, I was planning to sell ½ my position yesterday if it couldn’t reclaim 7.50 by 10:00 but I was watching it closely all day as well a crude futures and decided to continue to hold the full position for now. I continue to monitor the dollar closely and actually went long FXY (Yen) the other day and so far, that is playing out, helping to reinforce my believe that I pullback in the dollar is coming soon (which should give crude a boost). As always, I might change my mind at any time but for now, I still think at least a nice counter-trend rally in crude is likely to happen very soon.

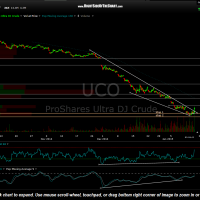

FWIW, the odds for a reversal in UCO/USO/crude futures is even higher now as all three have clearly broken out above bearish rising wedge patterns on the 60 minute time frames (see charts below). These breakouts have also been confirmed by above average volume which greatly increases the odds that the breakout will stick vs. fail as so many recent breaks above minor resistance in crude have done.

- CL 60 min Jan 14th

- UCO 60 min Jan 14th

- USO 60 min Jan 14th

Bottom line: While my trading style employs the use of flexible trading plans, those new to trading & investing as well as more experienced traders who do not have the luxury of being in front of their trading computer all day might be better off using a rigid trading plan, one that employs the use of OCO/OCA (one-cancels-the-other/another) orders, with a standing GTC sell limit order straddled by a stop-loss order on the other side, if the trade does not pan out. Those who work a 9-5 during the day can always modify those orders in the evening if something material has convinced you to modify your trading plan but be careful of being too liberal on your stops, especially when prone to booking quick & shallow profits. I strive to use a R/R (risk-to-reward ratio) of 3:1 or better on my trades. To be successful over time using anything less means that you will have very little margin of error to allow for losing trades.

Also keep in mind that although I do my best to sharing any new developments on the active trades & trade setups on RSOTC, I can not possibly share all developments that occur. The trade ideas shared here, many (but not all of which) I take personally, are exactly that; trade ideas. Most trades list multiple price targets and suggested stop levels but it is up to you to decide which trades to follow/trade/paper trade, etc… and how to trade them according to your own unique objectives, risk tolerance & trading style. Best of luck and as always, don’t hesitate to contact me if you have any questions or would like to share some suggestions or feedback on the site.