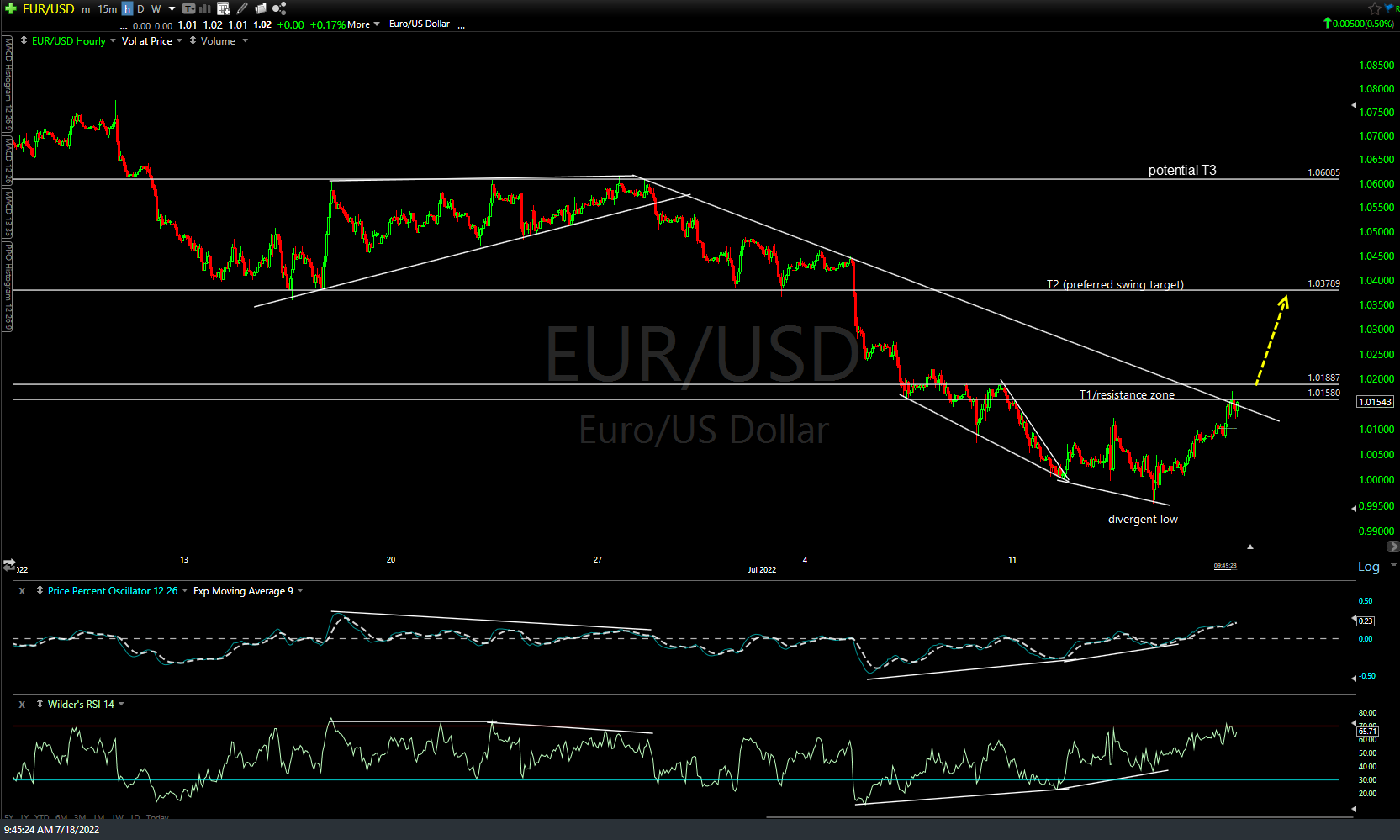

EUR/USD just hit the first price target, with the recent reversal still having the potential for a more significant trend reversal (bottom in Euro/top in the US Dollar). Previous (July 12th) 60-minute chart below.

From that July 12th post & long entry on the Euro (FXE, /E7 or short $USD), $EUR/USD went on a make a slight marginal new low while extending the positive divergences & hasn’t looked back since, with my fade of the “80%+ chance of a 100 basis-point hike at the next meeting” over-reaction last week in full force now, with the odds for a 1% hike at next week’s FOMC meeting plunging from over 80% following last Wednesday’s hotter-than-expected (but false) CPI report down to 30% as of today (which is bullish for the Euro, bearish for the $USD). Updated 60-minute chart of $EUR/USD below.

On a related note (as gold & the Euro typically has a positive correlation), today’s gap up in GDX (gold miners ETF) has the potential to put in that Island Cluster Reversal pattern discussed in last week’s videos, should this gap remain unfilled.