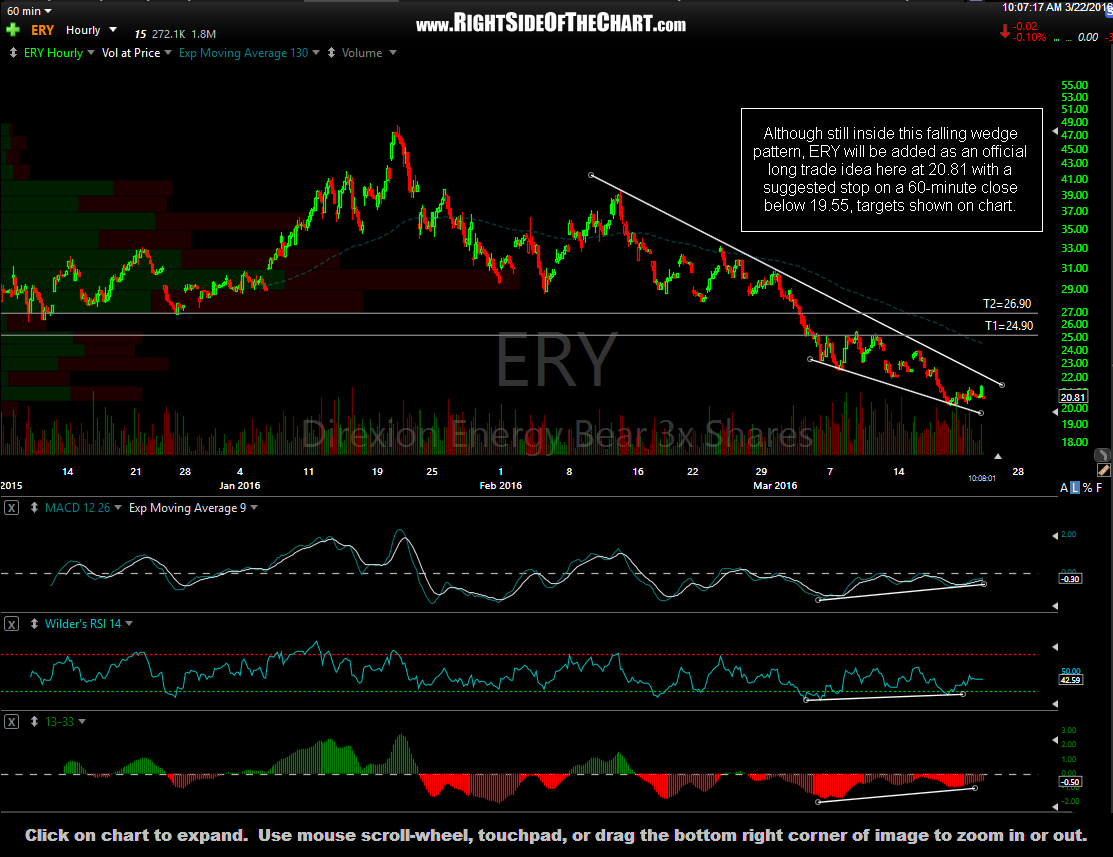

Although still inside this falling wedge pattern, a long entry/position ERY (3x energy sector bearish ETF) will be added as an official short trade idea here at 20.81 with a suggested stop on a 60-minute close below 19.55, targets shown on chart. To be clear, one would go long ERY to short the energy sector, as such this trade is Short Trade idea (Short Swing Trade Setup + Active Trade). While XLE traded right on the upper wedge line so far today, ERY appears to be well inside the wedge. This is simply due to the decay & the reason that I use the 1x ETF for charting purposed & timing entries & exits.

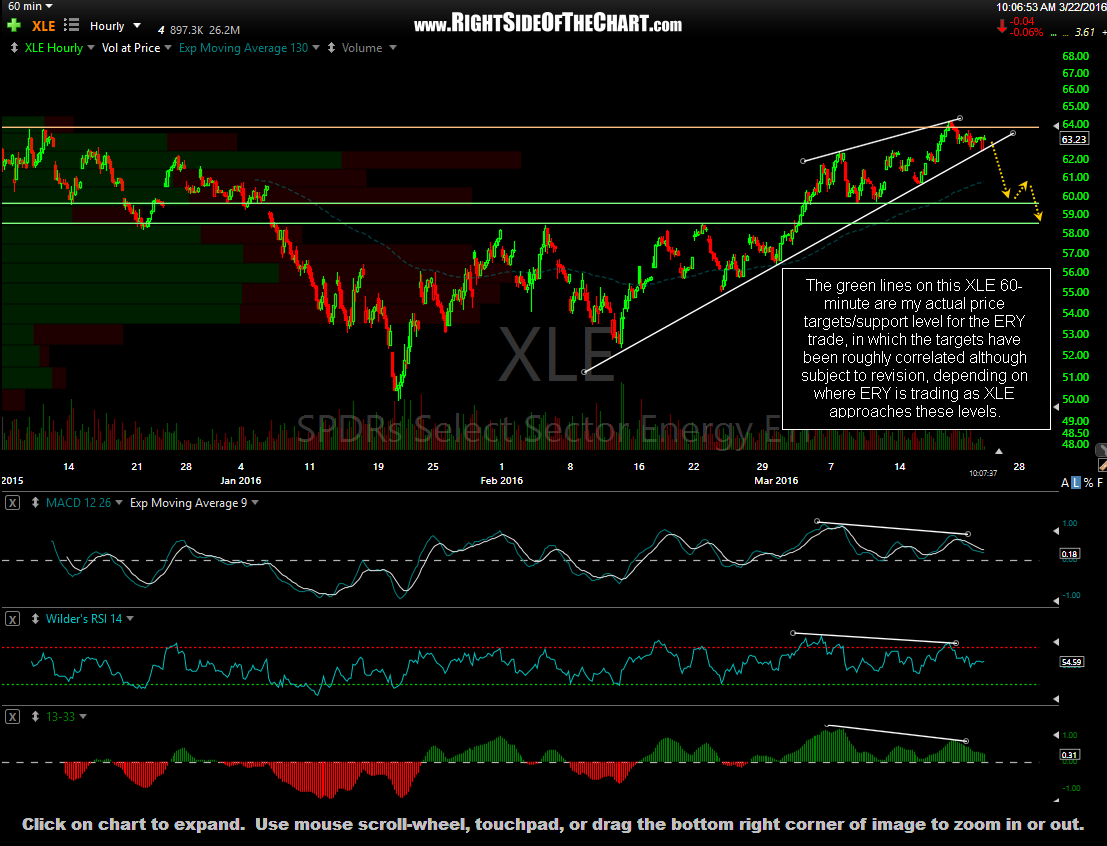

The green lines on this XLE 60-minute are my actual price targets/support level for the ERY trade, in which the targets have been roughly correlated although subject to revision, depending on where ERY is trading as/if XLE approaches these levels. So far, they’ve bought the gap up which means that the rising wedge on XLE has not yet broken to the downside, although I have a fairly high degree of confidence that it will based not only where prices are in relation to that wedge (which is also confirmed via bearish divergences) but even more so in the fact that on the daily time frame, XLE is overbought while challenging downtrend line resistance where at least a decent pullback is likely.

My preferred proxy and the official vehicle for this trade is ERY as my expectation is that this trade will be relatively unidirectional & a relatively short-term swing trade, probably several days to no more than a couple of weeks. Other options would be to short XLE (no decay from leverage), short ERX(3x) or DIG(2x) long energy etfs, taking advantage of any decay), or go long DUG (2x) short energy ETF. Various leveraged & non-leverage ETFs grouped by sector, index, commodities, etc.. can be found in the ETF center location on the main menu.