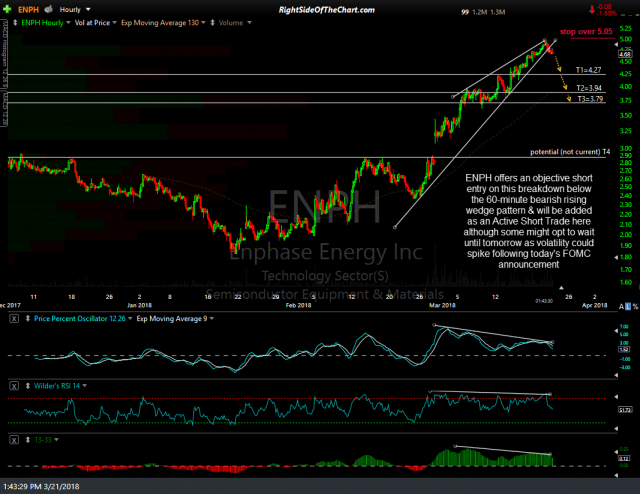

ENPH (Enphase Energy Inc) offers an objective short entry on this breakdown below the 60-minute bearish rising wedge pattern & will be added as an Active Short Trade here although some might opt to wait until tomorrow as volatility could spike following today’s FOMC announcement, resulting in today’s breakdown failing. Price targets (based on the 60-minute chart below) are T1 at 4.27, T2 at 3.94 & T3 at 3.79 with a potential fourth target around the 2.90 level.

- ENPH 60-min March 21st

- ENPH daily March 21st

The suggested stop for this trade is any move above 5.05. Due to the relatively low price & above average volatility as well as gain/loss potential for this stock, the suggested beta-adjusted position size is 0.75. My plan is to take a starter (1/2) position here, adding to the position if & only if the trade starts to play out with the stock moving lower in the wake of the FOMC announcement today & tomorrow.