Here are a few companies reporting earnings after the bell today that either have the potential to move the broad market tomorrow and/or might present a potential trading opportunity:

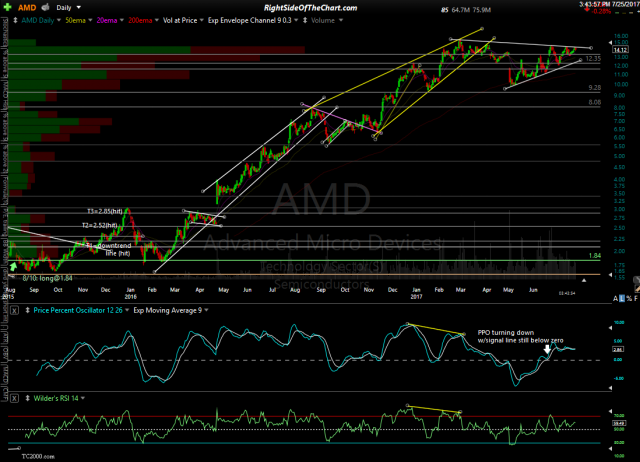

- AMD (Advance Micro Devices): One of the recent high-flying semiconductor & GPU manufacturers, currently poised to break above or below a triangle/consolidation pattern on the daily chart below.

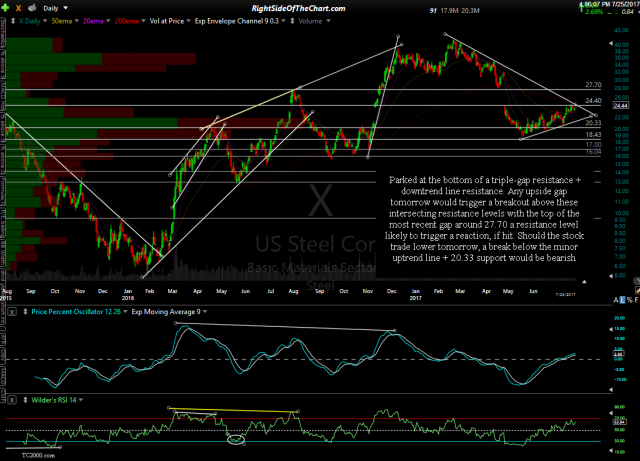

- X (US Steel): Parked at the bottom of a triple-gap resistance + downtrend line resistance. Any upside gap tomorrow would trigger a breakout above these intersecting resistance levels with the top of the most recent gap around 27.70 a resistance level likely to trigger a reaction, if hit. Should the stock trade lower tomorrow, a break below the minor uptrend line + 20.33 support would be bearish.

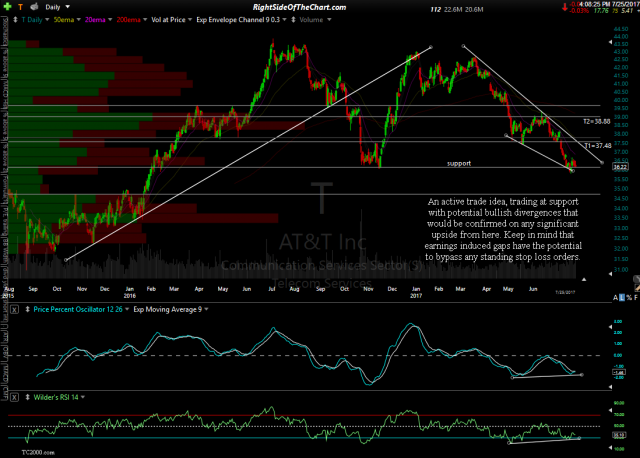

- T (AT&T Inc.): An active trade idea, trading at support with potential bullish divergences that would be confirmed on any significant upside from here. Details on that trade, including suggested stop & price targets, can be found here. Please keep in mind that earnings induced gaps have the potential to bypass any standing stop loss orders.

- AMGN (Amgen Inc): The largest biotechnology company & top component of most biotech ETFs. How this stock trades following earnings certainly has the potential to affect the biotech sector as a whole. Watching for a potential breakout to new highs although the odds for a false breakout are elevated until & unless the potential negative divergences are taken out.

- TXN (Texas Instruments): TXN is a leading semiconductor stock that looks ‘toppy’ after putting in a divergent high following an extended advance.

Keep in mind that quite often, the initial reaction to a company’s earnings report does not determine the next trend in the stock. Stocks will often experience an initial pop or drop in the after-hours or pre-market session, only to see it faded & then some after the conference call & forward guidance or at time, the initial pop or drop is faded despite the rosy or grim report & forward guidance. As such, I often find it best to wait to see how the stock trades during the regular session before opening or closing a position in wake of the earnings report.