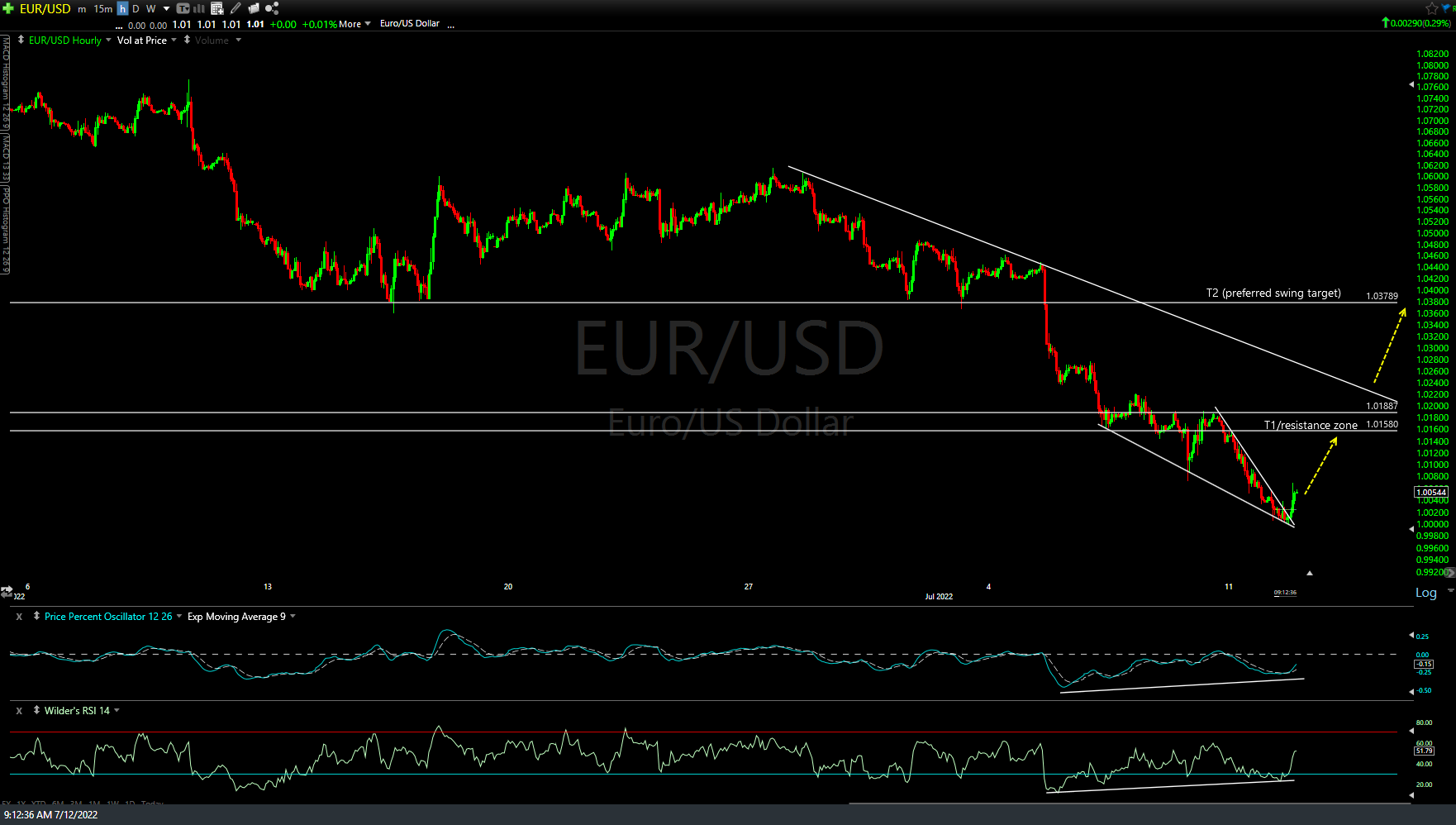

/E7 (Euro futures) offers an objective long entry on this breakout above the 60-minute bullish falling wedge pattern with positive divergences. Arrow breaks denote likely reaction levels (price targets) with a preferred swing target just below the 1.0428 resistance level & stops commensurate with one’s preferred price target(s).

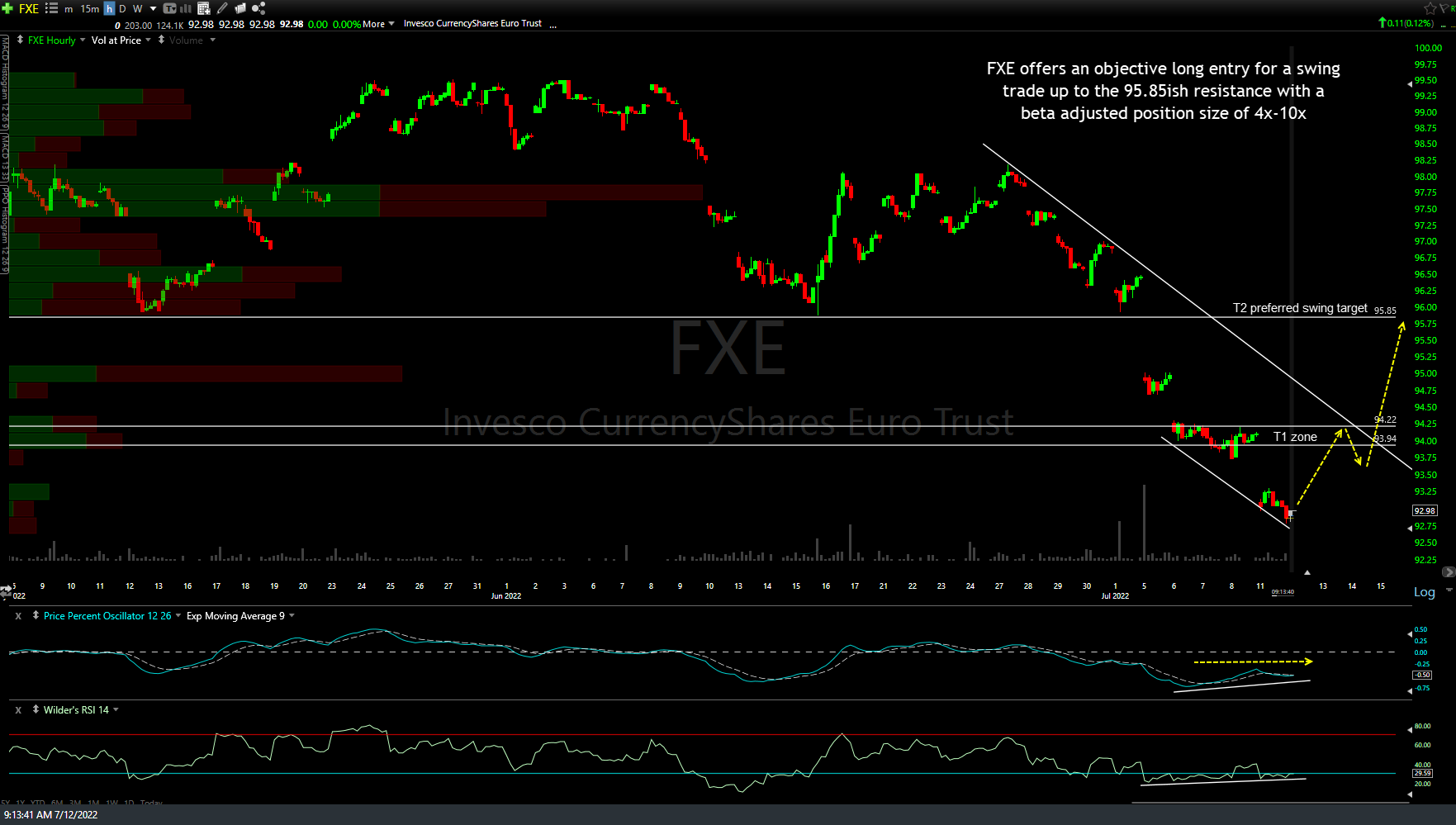

For those that don’t trade futures, FXE (Euro ETN) offers an objective long entry here for a swing trade up to the 95.85ish resistance with a beta adjusted position size of 4x-10x to account for the below-average risk & return potential as currencies don’t move nearly as much as equities or most commodities in percentage terms. 60-minute chart below.

60-minute chart of EUR/USD for reference below.