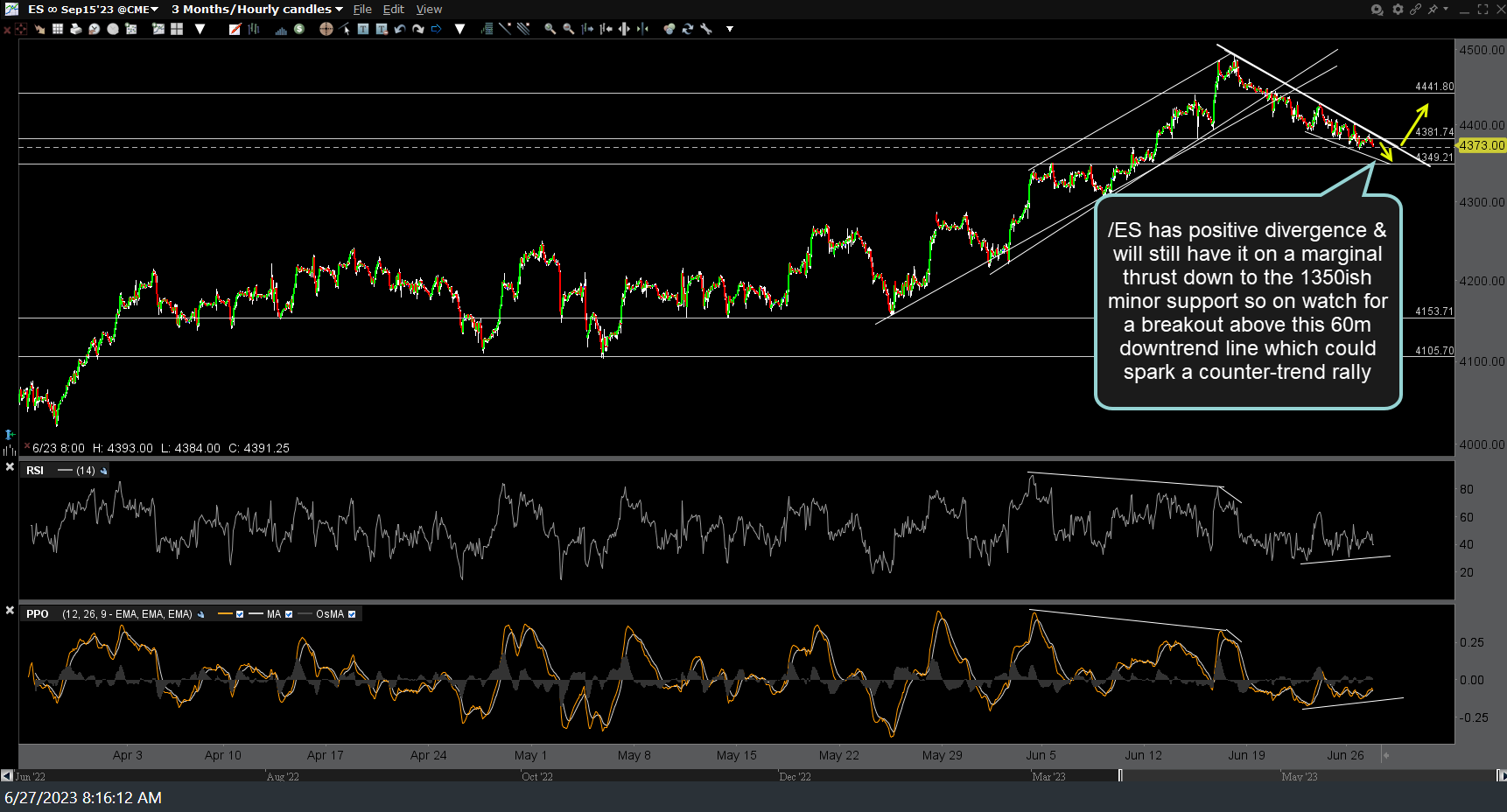

I was going to post this in the comment section under the previous update on the /NQ or QQQ short trade but figured it warrants a new post in case we get a solid breakout today. /ES (S&P 500 futures) has positive divergence on this 60-minute time frame & will still have it on a marginal thrust down to the 1350ish minor support so on watch for a breakout above this 60m downtrend line which could spark a counter-trend rally.

I wanted to point that out but will also add that during a tradable downtrend, such as the one that started when the stock indexes peaked on Friday June 16th, with QQQ falling over 4% so far, I prefer to see positive divergence on the 60-minute charts of both the futures as well as the ETFs (SPY and/or QQQ) before closing out all swing short positions and/or reversing to long. As such, I suspect that if /ES breaks out above the minor downtrend line above, it will likely be a short-lived stop-clearing pop followed by a reversal & drop down to my next price targets/support levels below.

How or if one trades any breakout above resistance or even a potential bounce off that support that /NQ hit yesterday & has been trading on since (as per the previous post) should depend on one’s trading plan & trading style (active trader vs. typical swing or trend trader).