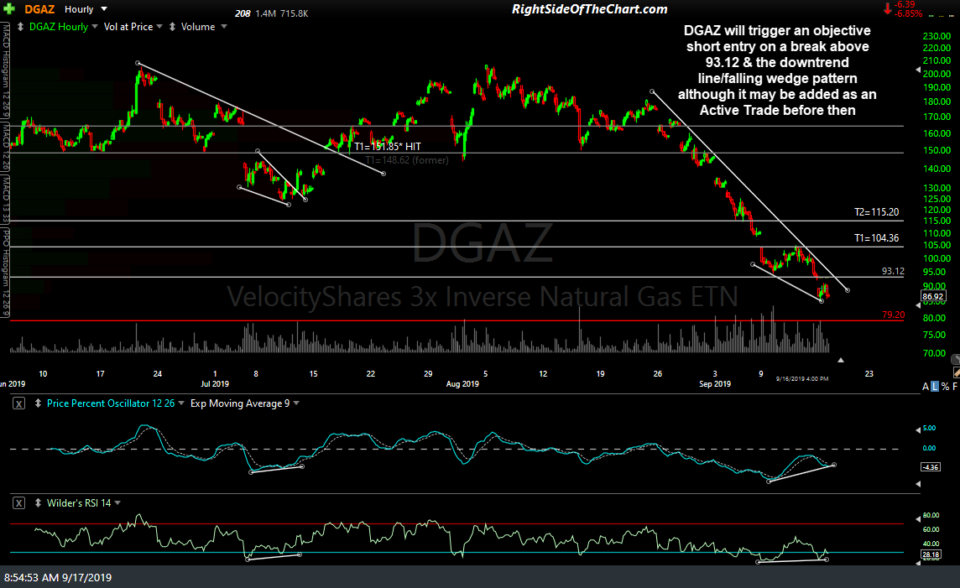

As the official trade ideas have been light due to unfavorable market conditions that have not been conducive to swing trading with the market trading mostly sideways for the past several months, I’m going to share this DGAZ (3x short natural gas ETN) trade idea as a potentially quick pullback trade on natural gas. To keep things simple, I only use regular trading hours for the official entries on the official trade ideas so while my preference is to take a starter position here in anticipation of a breakdown in /NG (nat gas futures) that has yet to occur but seems imminent at this time, I’ll wait to post the official entry point after the regular session is gets underway.

The price targets for DGAZ are T1 at 104.36 and T2 at 115.20 with a max. suggested stop at 79.20 (or higher if only targeting T1). Due to the 300% leverage on DGAZ, the suggested beta-adjusted position size is 0.35.

Although an unofficial trade (as officially trades are always individual stocks or ETFs/ETNs), /NG (natural gas futures) will trigger an objective short entry for an unofficial trade on a break below the 2.639 & uptrend line support with price targets slightly abov ethe 2.533 & 2.469 support levels.