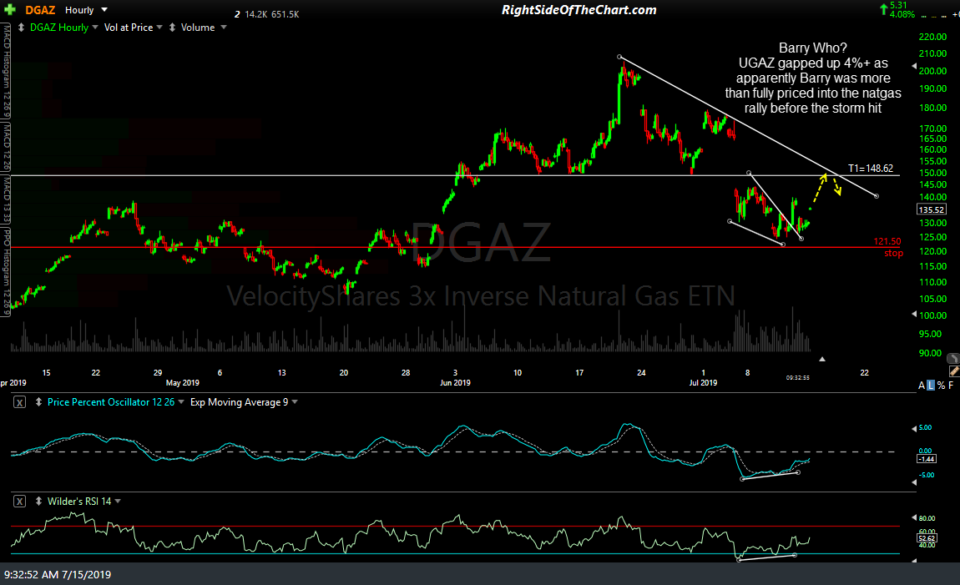

The DGAZ (3x short natural gas ETN) gapped up beyond the former first & only price target of 148.62 to open at 151.85 today, where any standing sell limit orders would have been triggered & filled. This provides a quick 3-trading session total gain of 19.3% or a beta-adjusted gain of 5.8% on the trade.

- DGAZ 60-min July 12th

- DGAZ 60-min July 15th

- DGAZ 60-min July 16th

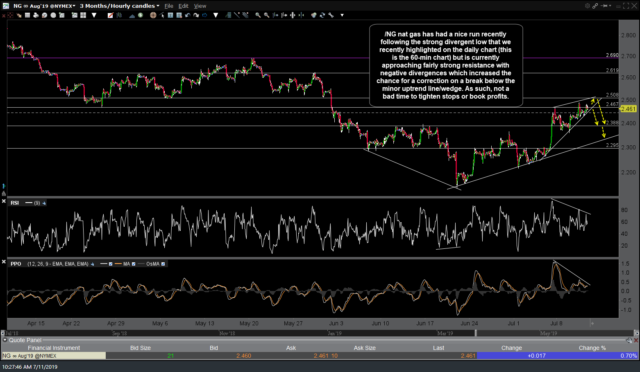

/NG (nat gas futures) have made a momentum-fueled overshoot of the trendline in which I was targeting. I’ve also added an alternative trendline which /NG has now hit thereby also providing an objective time to either book the quick profits or lower stops (which I’m doing personally) for those that used /NG as the trading proxy for this trade. Should /NG continue to fall without much of a reaction off these uptrend lines, my final target is just above the 2.295 support level. Should that level be hit soon, it might also provide an objective long entry/reversal trade on /NG.

- NG 60-min July 11th

- NG 60-min July 12th

- NG 60-min July 15th

- NG 60-min July 16th

Likewise, should /NG reverse here off the downtrend line & rally back up towards the 2.388 former support, now resistance level, that might also offer another objective short entry, assuming the charts confirm at the time.