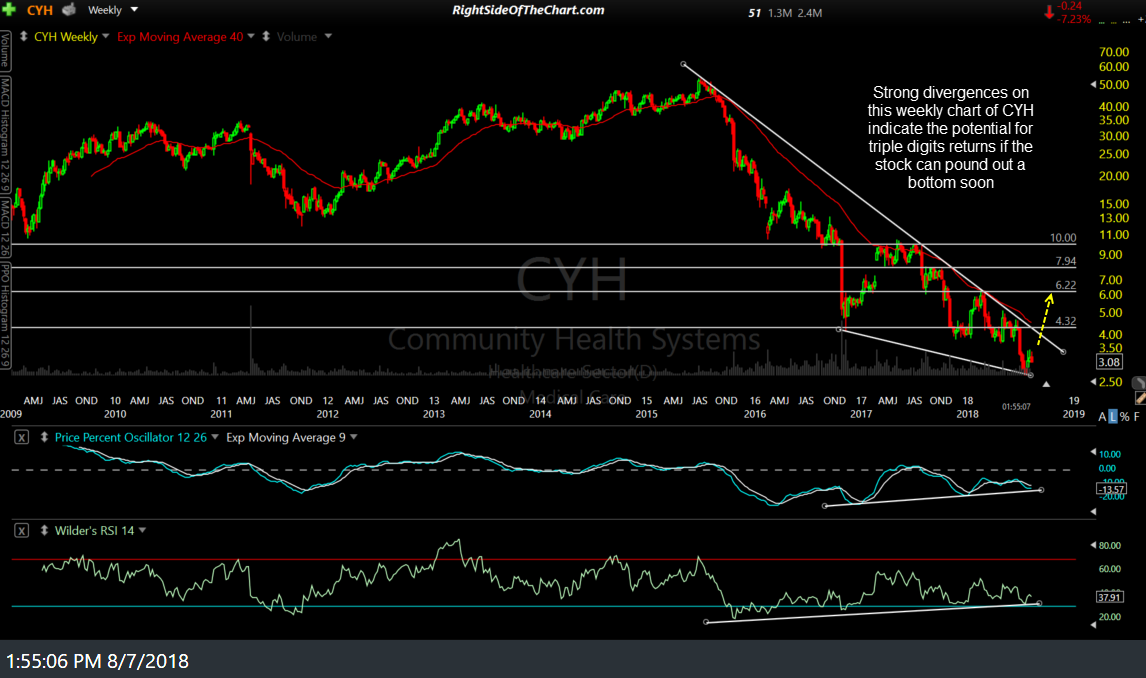

CYH (Community Health Systems) is on watch for a possible bottoming play/Long-Term Trade. Strong divergences on this 10-year weekly chart indicate the potential for triple digits returns if the stock can pound out a bottom soon.

Zooming down to a 2-year daily chart it appears that while CYH still has plenty of work to firm up the case for a bottoming play, a break back above the 3.80 level, as well as the downtrend line, would certainly be a start as that would be a likely catalyst for a rally up to the 4.70 & then 6.00 levels.

I plan to keep this one on my radar & will consider adding it as an official trade setup as/if it CYH breaks above the recent trading range of about 3.05-3.50 but wanted to pass the setup along at this time for those interested. As of now, CYH is a low-priced stock solidly entrenched in a bear market without any signs of a bottom at this time.

Community Health Systems, Inc., together with its subsidiaries, owns, leases, and operates general acute care hospitals in the United States. It offers general acute care, emergency room, general and specialty surgery, critical care, internal medicine, obstetrics, diagnostic, psychiatric, and rehabilitation services, as well as skilled nursing and home care services. The company also provides outpatient services at urgent care centers, occupational medicine clinics, imaging centers, cancer centers, and ambulatory surgery centers. As of December 31, 2017, it owned or leased 125 hospitals, including 123 general acute care hospitals and 2 stand-alone rehabilitation or psychiatric hospitals with an aggregate of 20,850 licensed beds in 19 states. The company was founded in 1985 and is headquartered in Franklin, Tennessee. source: yahoo finance