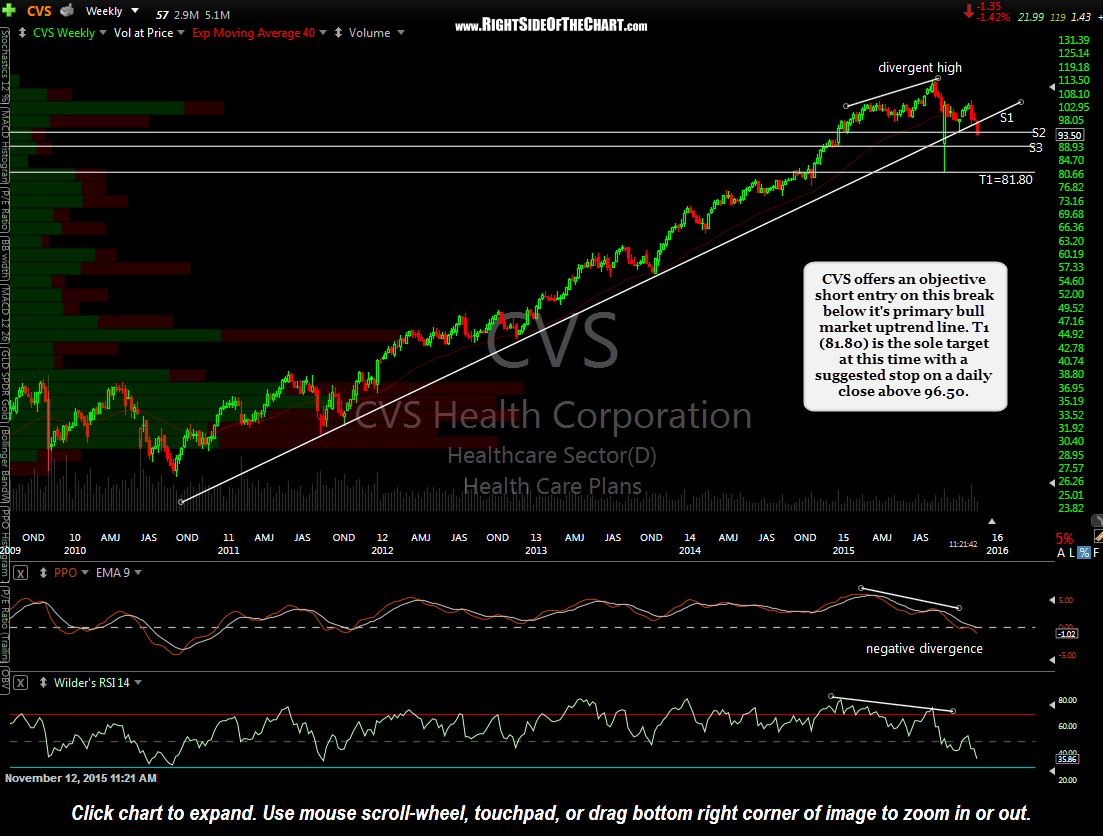

CVS (CVS Health Corporation) offers an objective short entry on this break below it’s primary bull market uptrend line. T1 (81.80) is the sole target at this time with a suggested stop on a daily close above 96.50.

Keep in mind that CVS is a direct competitor to the WBA short trade idea posted earlier and as such, the charts are very similar. As birds of a feather flock together, these two trades (and I may add some others in the sector) are likely to move in close unison. When trade stocks, diversification amongst sectors & industries, not just individual positions, is every bit as important as it is when investing. As such, if you plan to eventually build a short position of, say, 20% in the health care sector for example, then that needs to be taken into consideration when establishing each position, in order to make room for additional individual positions within that sector that may be added later.

Of course one could opt to short XLV or any other health care sector ETF in lieu of trading individual stocks within the sector. Just eyeballing the chart of XLV, I’d say a trip down to at least the 60.70 area in the coming weeks to months is likely (a drop of roughly 15% from current levels).