Crude oil made an impulsive breakdown below the primary uptrend line off the Dec 24th lows on Friday which puts crude oil & the energy sector on a sell signal. However, two of the 3 major sub-sectors in the oil & gas energy sector, XOP (Oil & Gas Exploration & Production ETF) and the more significant XLE (SPDRs Select Energy Sector ETF), which is one of the 11 sectors within the S&P 500, both fell to & close on trendline support on Friday.

- CL daily April 29th

- USO daily April 29th

- XLE daily April 29th

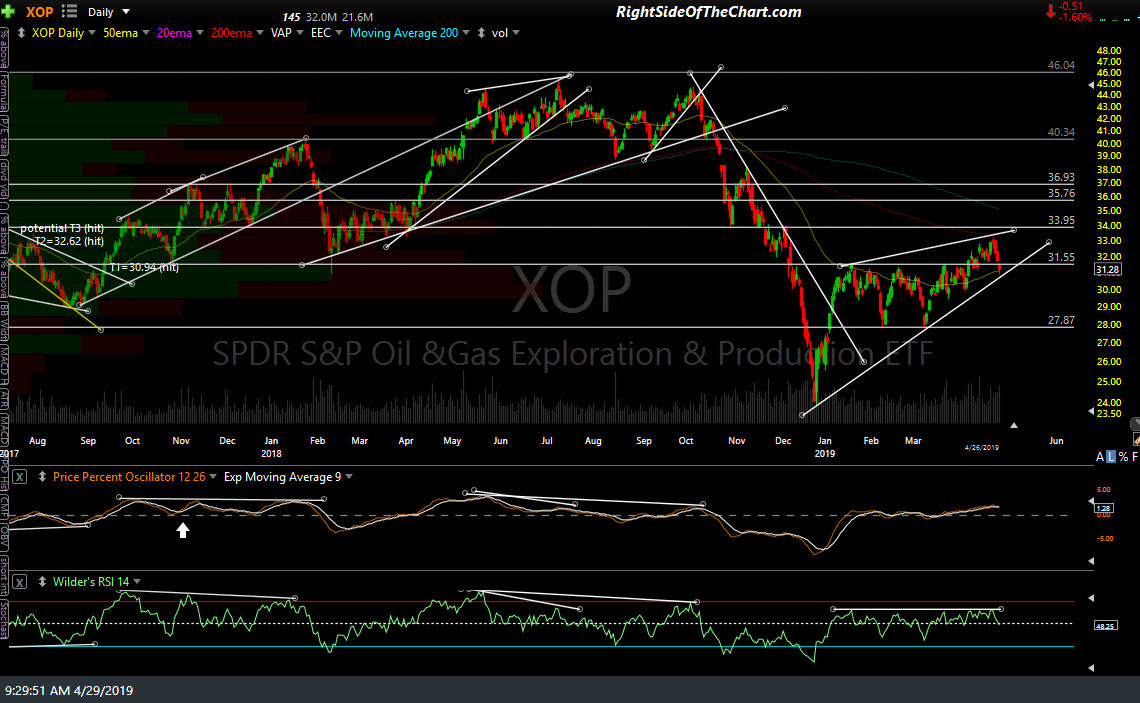

- XOP daily April 29th

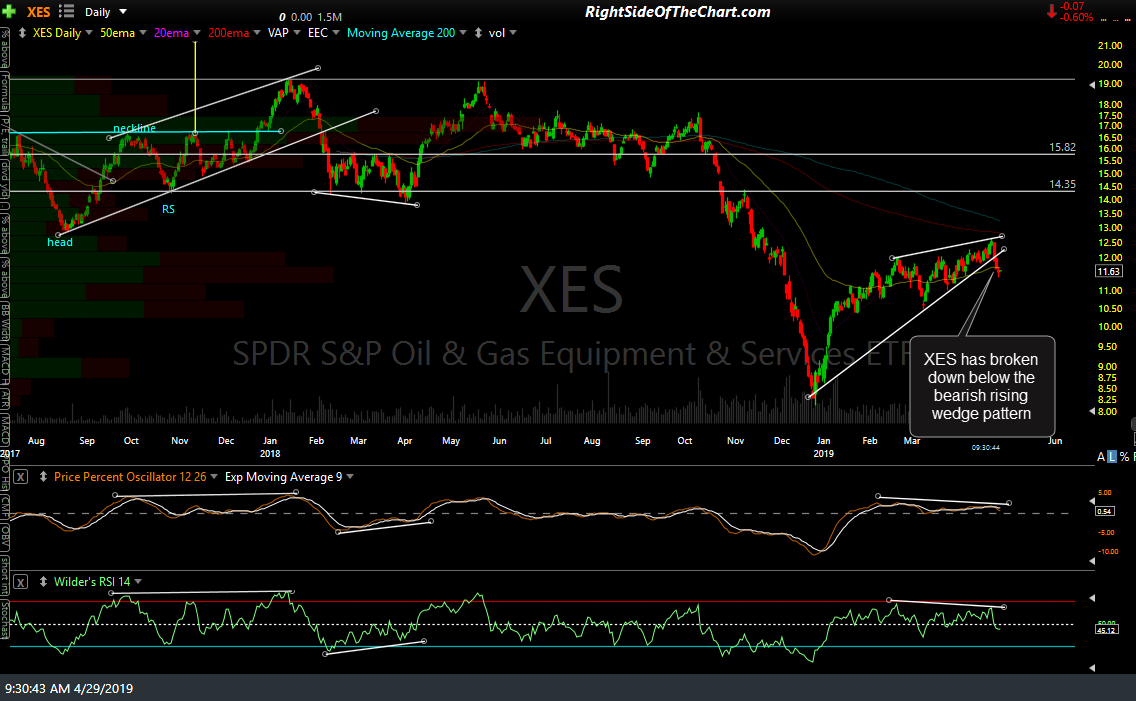

- XES daily April 29th

As such, I’ll be watching to see if we get a reaction off those support levels which would be likely if crude oil has a snapback rally this week. Should that prove to be the case, a backtest of the primary uptrend line in crude oil would offer another objective sell signal although /CL is currently backtesting the 63.14 price target/former support, now resistance level, thereby offering an objective short entry (with a relatively tight stop) at this time.